Written by: Richard Fortin and Brendan Harrington

Almost 40 years ago, English rock band Genesis released its hit single “Land of Confusion” which climbed the charts in the US and the UK. During the latter stages of the Cold War, the single was viewed by some as a protest song of the era, capturing anxieties and uncertainties while putting forward thoughtful commentary on the global political climate, social unrest and desire for a better future. The song’s lyrics highlighted the sense of chaos and disharmony that prevailed globally during that period.

More of the same in store for 2025?

The Trump administration’s tumultuous first six weeks in office reinforce the present-day relevance of “Land of Confusion” and its key themes. On the one hand, the notion of US exceptionalism continues to drive expectations of sustained US economic outperformance and US stock market leadership early in 2025 (not unlike what transpired in 2024). US economic growth is expected to lead all developed economies for the upcoming year while the S&P 500 Index is also expected to produce leading earnings growth and profitability when compared to most other global equity markets. Lower corporate tax rates and deregulation championed by the new administration, alongside high levels of business investment, should remain important themes going forward.

The US technology sector is a market juggernaut by virtue of its size (accounting for 31% of S&P 500 capitalization) and its outsized contribution to growth expectations. Not surprisingly, sentiment remains positive toward US technology given the level of investment currently taking place in the sector (i.e., hyper-scalers are expected to spend nearly $340 billion on artificial intelligence investments in 2025), which is acting as an important driver of earnings growth for the broader market.

Maybe not

On the other hand, risks appear to be mounting on a number of fronts which could upend this rosy narrative. Although US consumer balance sheets are healthy, some leading retailers have recently noted that consumers are still stressed following several years of above-trend inflation, effectively forcing a ‘trade down’ effect on overall consumption. This strained consumer dynamic was evident in last week’s release of US consumer spending data which showed a sequential decrease of 0.2% in January – the first such decline in over 2 years. February US consumer confidence data, also published last week by the Conference Board, registered its largest monthly decline since August 2021.

Although we don’t have enough data points on any of these measures to label a trend just yet, the prospect of waning business and consumer confidence, as above-trend inflation suppresses growth, injects some uncertainty in an otherwise constructive outlook for 2025. This also complicates the path forward for the Federal Reserve as it looks to further reduce its target rate to sustain the current economic expansion.

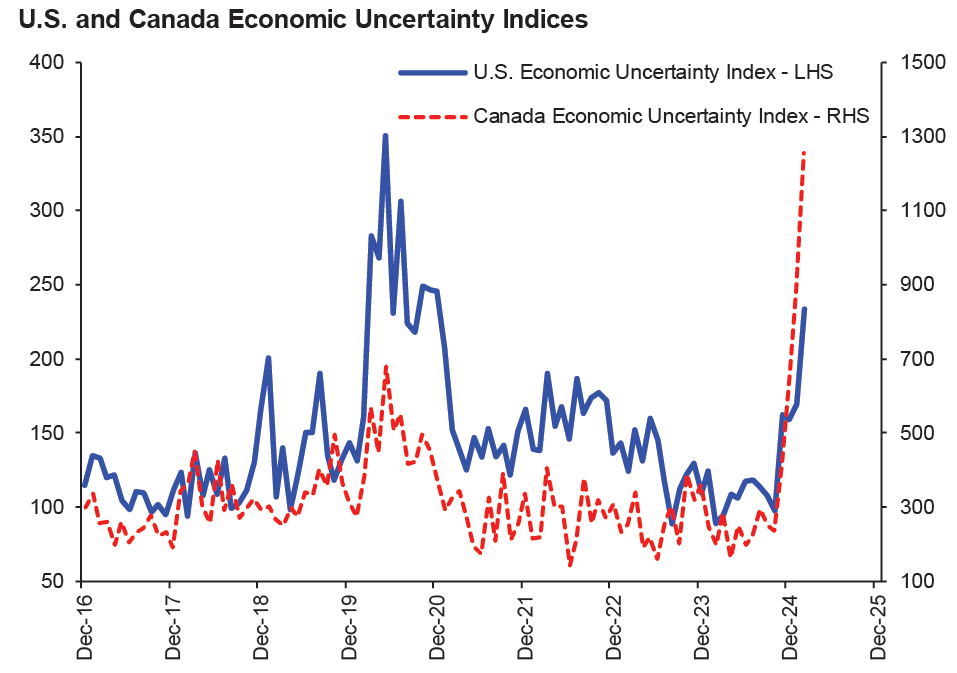

However, the “Land of Confusion” theme is perhaps most noticeable when attempting to assess the impact from the array of policy initiatives (i.e., tariffs, immigration and DOGE to name a few) being implemented by the Trump administration since moving into the Oval Office. The threat of “on again/off again” US tariffs being implemented against key trading partners (not to mention retaliatory tariffs) is top of mind for consumers and investors alike, as such actions risk disrupting global commerce while further stoking already elevated inflation levels in the US. In addition, the increasingly complex global geopolitical landscape (Middle East, Russia/Ukraine, China) is also adding an additional layer of risk to the upbeat outlook for stocks and the economy. Collectively, these factors are generating high levels of uncertainty in both the US and Canada.

Source: Scotiabank GBM Portfolio Strategy, Bloomberg.

Transition to a “risk off” market environment?

Overarching all these factors is a cyclically elevated valuation environment for large cap US equities (22x forward earnings) which discounts little, if any, of these risks. The S&P 500 earnings yield spread versus the 10-year US Treasury Bill yield (the premium investors require for the risk of owning equities) is also near decade lows, suggesting that investor risk appetite remains at historically elevated levels. Nonetheless, it is interesting to note that on a year-to-date basis (to February 28), the S&P 500 return of 1.4% has been largely driven by defensive sector leadership, with healthcare (+8%) and consumer staples (+8%) among the top performing areas of the market.

Conversely, the previously leading technology and consumer discretionary sectors have lagged – posting returns of -4% and -5%, respectively, over the same timeframe. Similarly, the “Magnificent 7” group of stocks have declined nearly 8% thus far in 2025 versus returns of +78% and +46% in 2023 and 2024, respectively. This leadership reversal – in favour of lower growth, more defensive business models – is worth noting, as it could be indicative of waning investor risk appetite in the face of mounting economic, financial market and geopolitical uncertainties.

Shelter from the storm

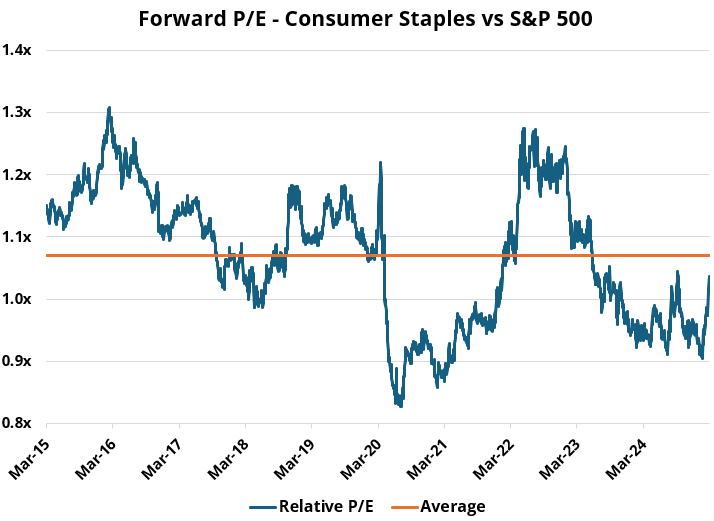

Fortunately, even in a land of confusion and volatility, refuge can be found in traditionally resilient sectors that have recently been overlooked in favour of higher growth areas of the market. Despite posting strong returns to-date in 2025, the consumer staples sector is one such area that provides steady growth, stable cash generation and attractive dividend yields at relatively low historical valuations.

Source: S&P Capital IQ

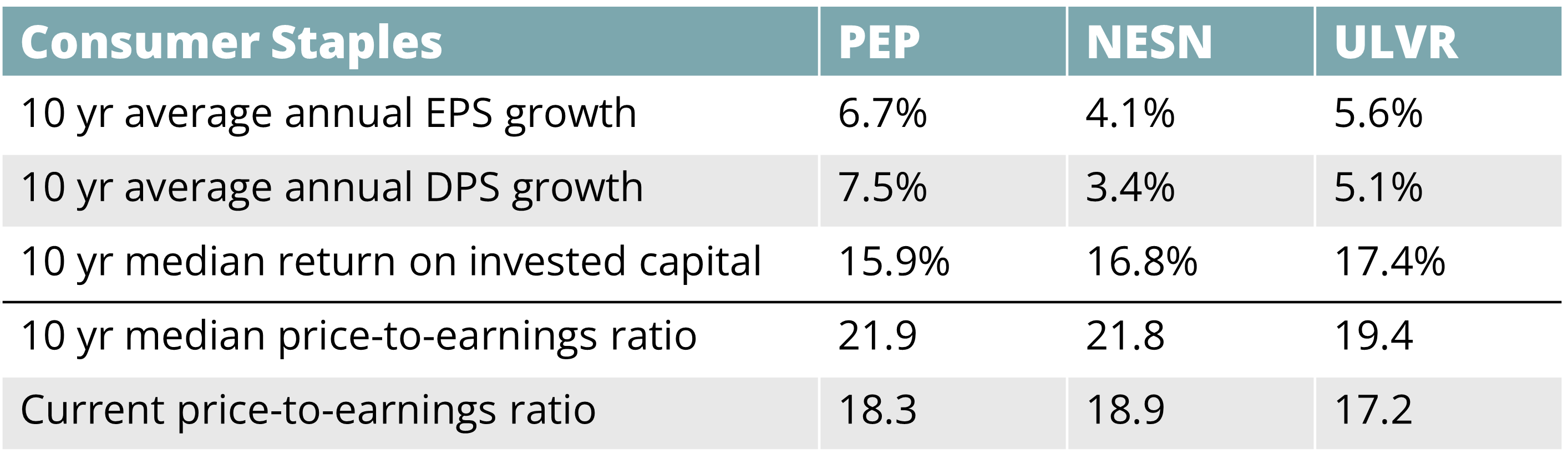

Key QV portfolio holdings in this sector include PepsiCo (NASDAQ: PEP), Nestle (SWX: NESN) and Unilever (LSE: ULVR). These market-leading franchises sell everyday consumer necessities, while owning some of the most well-known and beloved brands in their respective categories. What they may lack in terms of technological hype, they more than make up for with high returns on capital, persistent annual earnings and dividend growth, along with low historical valuations as shown in the table below. We believe investors will ultimately seek out the reliability offered by these types of investments should geopolitical and economic risks increasingly prevail.

Source: S&P Capital IQ

QV’s balanced approach to portfolio construction has consistently yielded a diversified group of high quality and resilient franchises, emphasizing a reasonable margin of safety for a variety of outcomes. As such, our portfolios are well positioned to thrive on a relative basis as market leadership transitions within a more risk-averse environment. While this type of investing makes sense to us in all markets, it has not been the flavour of the day in recent years, as investors have overlooked long-term earnings durability in favour of flashy here-and-now growth strategies. As the tide goes out on this growth hype chapter, we think QV portfolios are prudently positioned to exhibit comparatively robust earnings growth with lower volatility and less downside capture.