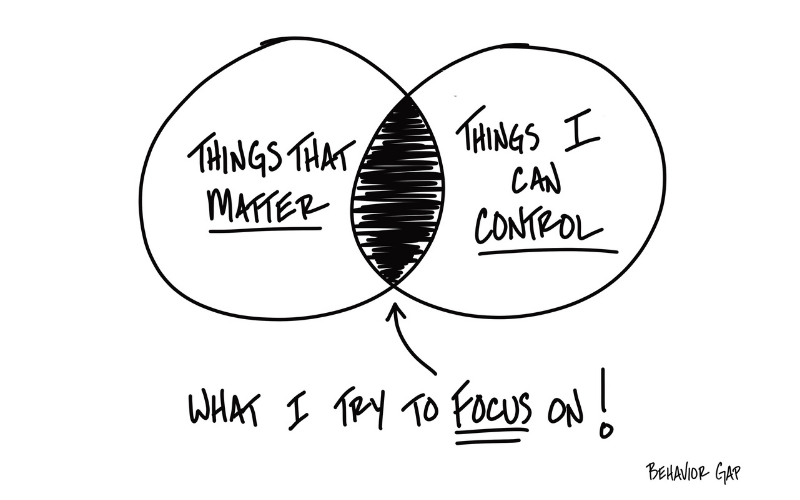

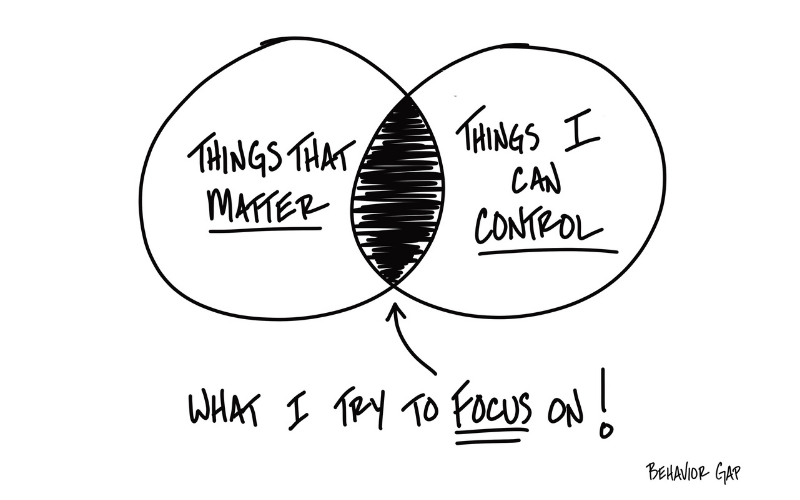

Market volatility can be dizzying, but for long-term investors with a little financial discipline, there are plenty of opportunities.

Market volatility can be dizzying, but for long-term investors with a little financial discipline, there are plenty of opportunities.

While receiving a cash inflow should be a cause for celebration, it can also be stressful, as it comes with a decision: how should you use it?

With the sudden prorogation of Parliament, many Canadians are left wondering how the proposed increase to the capital gains inclusion rate will impact them.

How much do you know about optimal RRIF withdrawals? The complex decision may impact the taxes you pay and the legacy you leave to your loved ones.

This note provides preliminary guidance on the estimated capital gains to be distributed from our pooled funds at the end of the year.

An overview of types of financial abuse and how you can protect yourself and your loved ones.