QV’s fixed income team unpack recent moves in bond yields and take a step back to focus on fundamentals amidst the turbulent market narratives.

QV’s fixed income team unpack recent moves in bond yields and take a step back to focus on fundamentals amidst the turbulent market narratives.

While our economic system is not always perfect, there are powerful incentives at play for investors that can stomach a little volatility.

While the “tariff war” causes waves in the markets, we sleep well at night knowing we’re invested in companies that are prepared for these trying times.

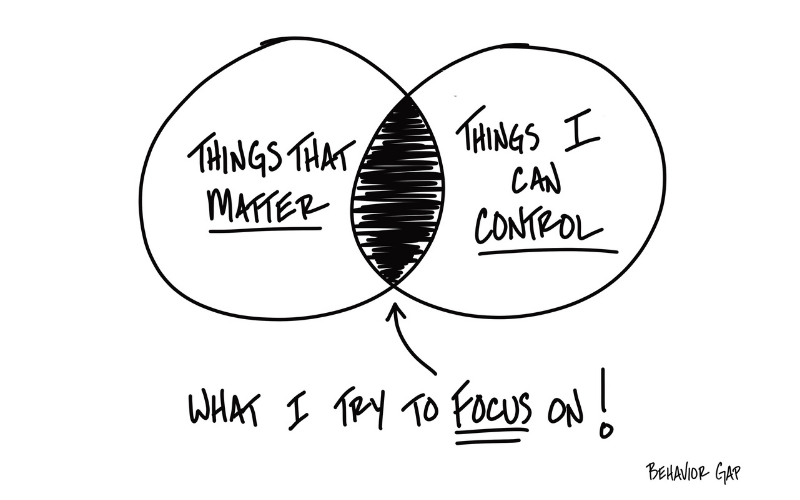

Market volatility can be dizzying, but for long-term investors with a little financial discipline, there are plenty of opportunities.

Trade disruptions, government cutbacks & market volatility are creating a challenging environment – but our investment process has prepared us for these times.

VP & Portfolio Manager Steven Kim details our Seven Tests framework, which is grounded in fundamental analysis and guides our investment process.

As economic and geopolitical chaos dominate much of the narrative, refuge can be found in traditionally resilient, but recently overlooked, sectors.

While receiving a cash inflow should be a cause for celebration, it can also be stressful, as it comes with a decision: how should you use it?

Given the apparent strength of the U.S. economy and stock market, you might wonder why our Global Small Cap Strategy only holds a ~13% weight in U.S. equities?

With the sudden prorogation of Parliament, many Canadians are left wondering how the proposed increase to the capital gains inclusion rate will impact them.