There are moments in life when you may come into a lump sum of money, like a work performance bonus, or perhaps a more significant amount from a business sale or inheritance.

While receiving a cash inflow should be a cause for celebration, it can also be stressful, as it comes with a decision: how should you use it? If you choose to invest, the next question is whether to invest now or wait for a better opportunity.

Data suggests that investing your money right away is generally the best approach. However, if you’re particularly risk-averse, dollar-cost averaging (DCA) – investing fixed amounts into your strategic portfolio1 at regular intervals – is a strategy worth considering.

If you’re unsure how to proceed when given the opportunity to invest a large sum of cash, this note will help you get invested in a way that suits your personality, risk preferences and investment objectives.

The Mental Accounting of New Money

You could be content with a million dollars invested in a balanced and diversified portfolio yet find yourself uncertain when an additional hundred thousand suddenly comes your way.

Imagine the regret of investing a lump sum into the market days before a stock market crash. The timing would be unlucky, but the loss on your “old” money would be ten times larger. New money feels disproportionately more precious than old money.

Many people intuitively turn towards DCA to reduce the risk of unlucky market timing on the whole sum at once.

If that’s what it takes to get your new money invested, that’s great. Slow is better than never.

Dollar Cost Averaging is Still Market Timing

DCA seems to get around the market timing dilemma, but I would argue it is an even greater form of market timing risk than investing the lump sum immediately. A shift in perspective is needed to see it this way.

Let’s suppose you choose to dollar cost average your new money into your strategic portfolio over the next year via twelve monthly installments. By doing so, you are betting that cash will outperform your strategic portfolio over the next year. That’s a bold bet considering the evidence.

Research from developed markets demonstrates that immediately investing a lump sum is superior to dollar cost averaging about two-thirds of the time. That’s true if your strategic asset mix is all equities or a balanced portfolio of equities and fixed income. Vanguard’s research, based on data from 1926-2011, demonstrates that for U.S.-based 60%/40% balanced portfolios, lump sum investing outperformed 12-month DCA by 2.3%.

Minimizing Your Risk of Regret

If you sell a business for a million dollars, it’s completely understandable that you might wish to play it safe by averaging into the market. Dollar-cost averaging will prevent you from getting the worst possible outcome and the regret that comes with poor timing.

If you think DCA would help you sleep better, then statistics be damned, you should dollar-cost average. Just accept that playing it safe will likely cost you money. There’s nothing wrong with accepting a lower expected rate of return if it comes with peace of mind.

The Psychological Hazards of Dollar Cost Averaging

Dollar cost averaging can create a whole new set of behavioural challenges.

Let’s say you’ve decided to DCA in six equal monthly installments. If the market suddenly falls 10%, will you stick to the plan, or stop buying because the market could fall another 10%? Or what if stocks quickly rise 10%. Will you pause your DCA in hopes the market comes back to you? Do you want to pay the cognitive and emotional price of having this on your mind every morning?

The premise of DCA is that you have a heightened aversion to risk. If this is true, attempting to execute DCA yourself is probably inconsistent with your sensitivity to fear and regret, which could make it challenging to stay on track with your goals. To avoid these emotional biases, the best way to implement DCA is to let a trusted and experienced investment manager do it for you.

Set a Plan and Leave it to Us

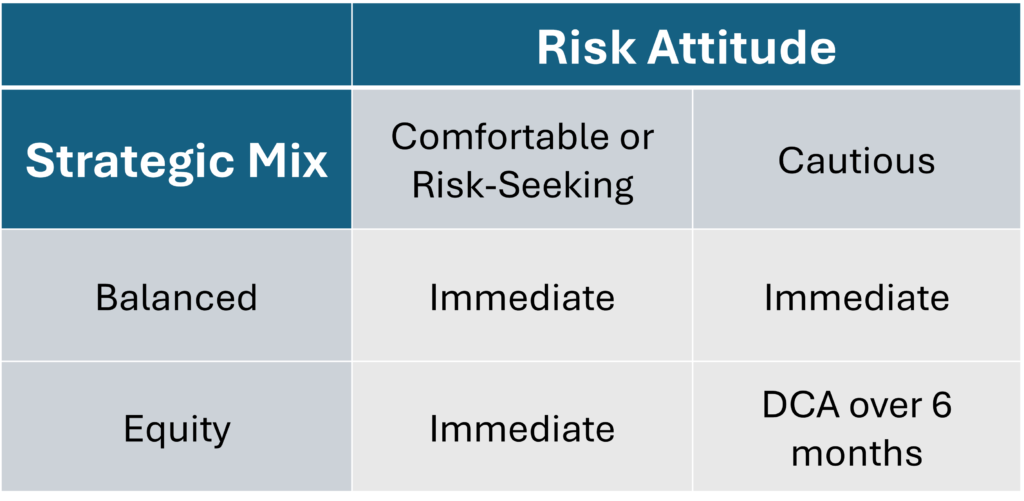

In general, we suggest the following approach to investing a lump sum, dependent on your risk attitude and the asset mix of your strategic portfolio. You can then discuss any modifications with your QV Investment Counsellor to land on an approach that is best suited to you.

Source: QV Investors

- Your strategic portfolio is the asset mix designed to meet your long-term financial goals, according to your personal risk profile. ↩︎