While the tax changes coming into effect in 2026 may appear incremental, small adjustments can add up over time, particularly for higher-income Canadians. We’ve consolidated some of the latest CRA announcements and summarized the important dates and program changes that may impact your situation.

Marginal Tax Rate & Income Threshold Changes

The most notable change was a 1% reduction in the lowest federal marginal tax rate, decreasing from 15% to 14% for individuals earning up to $58,523. This reduction was phased in over two periods: an initial 0.5% cut effective July 1, 2025, followed by the full 1% decrease as of January 1, 2026. While not a significant shift, federal income tax thresholds for Canadians earning more than $58,523 were also modestly increased in line with inflation. These figures reflect federal rates only and do not account for provincial income taxes, which vary by jurisdiction.

OAS Clawback & LCGE

Many Canadians will welcome the increase in the Old Age Security (OAS) clawback income threshold to $95,323, up from $93,454 last year. While the threshold provides a helpful reference point, OAS is assessed on a calendar-year basis, meaning the amount of income taken in any given year can influence the degree of clawback. Thoughtful planning around how income is drawn over time can help manage this exposure more effectively.

Individuals considering the sale of qualified small business corporation shares or qualified farm or fishing property should note that the Lifetime Capital Gains Exemption (LCGE) has increased to $1,250,000 for dispositions occurring on or after June 25, 2024, with indexation resuming in 2026. Because the LCGE is a lifetime, per-individual limit, understanding the timing of capital gains across dispositions can help ensure the exemption is used effectively.

First Home Savings Accounts

A fairly new addition to Canada’s suite of registered accounts is the First Home Savings Account (FHSA), designed to help first‑time home buyers aged 18 to 71 save for a qualifying home purchase in a tax‑efficient way. With an FHSA, you can contribute up to $8,000 per year, subject to a lifetime contribution limit of $40,000 once the account is opened, and unused annual room can be carried forward up to $8,000. Contributions are deductible from taxable income in the year they are made, and qualifying withdrawals to purchase a first home are tax‑free, making the FHSA a powerful tool to support home ownership.

RRSP Contribution Limits

Looking to make your RRSP contributions this year? At QV, we can help facilitate contributions for the 2025 tax year up until March 2, 2026, at 12:00 PM MST. For 2025, the maximum contribution is the lower of 18% of your earned income for 2024 and $32,490. Looking ahead, the maximum contribution for the 2026 tax year will be $33,810. Any unused RRSP room can be carried forward to future years, giving you flexibility in your retirement savings strategy.

RRSPs remain one of the most effective tools available to reduce taxable income, particularly for salaried employees and individuals in higher marginal tax brackets. Contributions are deductible against income in the year they are made, which can result in a meaningful reduction in current-year tax payable while allowing investments to grow on a tax-deferred basis until withdrawal.

If you’d like, we’d be happy to run a personalized projection to estimate the potential tax savings of an RRSP contribution and help determine an appropriate contribution level based on your income, marginal tax rate, and longer-term planning goals.

TFSA Contribution Limit

For 2026, the annual TFSA contribution limit remains at $7,000. A Tax-Free Savings Account is a flexible way to save or invest: any money you withdraw from your TFSA is added back to your contribution room in the following year, so you can recontribute later without losing your room. This makes it a great place to park your money, watch it grow tax-free, and access it whenever you might need it. Once you know you don’t need the funds for immediate use, you can also transfer that money into an RRSP to benefit from a tax deduction for the contribution.

In addition, any unused contribution room from previous years can be carried forward. If you have never contributed to a TFSA and have been eligible since the account was introduced in 2009, your cumulative contribution room totals $109,000.

Where Can I Find My Contribution Room?

If you are considering making a contribution or reviewing your registered account strategy, a helpful first step is confirming your available contribution room for both your TFSA and RRSP. This information can be accessed online through CRA My Account or by contacting the CRA directly at 1-800-267-6999.

CRA records are updated periodically rather than in real time, so recent contributions, particularly those made during 2025, may not yet be reflected in your reported limits. Taking the time to review your contribution history can help ensure accuracy and reduce the risk of overcontributing, which may result in penalty taxes.

Understanding your available room is an important part of broader tax and retirement planning, and it’s a valuable conversation to have with your QV Investment Counsellor to ensure contributions align with your overall financial plan.

How to Contribute

We would be happy to assist with facilitating contributions. Funds can be drawn from your bank account or transferred from your existing investment holdings, including non-registered and registered accounts, where appropriate.

To ensure contributions are processed smoothly, please confirm that sufficient funds are available at the time of transfer, as QV cannot be held responsible for any charges resulting from insufficient funds. Please also note that RBC Investor & Treasury Services no longer accepts cheques, and all contributions must be completed electronically.

If you have any questions or would like help coordinating a contribution, your QV Investment Counsellor is always happy to assist.

Tax Reporting Timelines

Below we have outlined important dates and information to help guide you through the upcoming tax season.

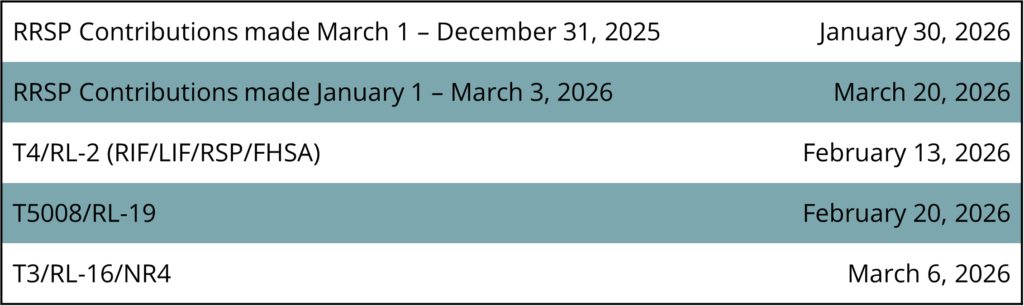

Clients invested in the QV Pooled Funds should expect to see 2025 tax slips delivered according to the following estimated schedule:

Clients invested in segregated securities should expect to receive tax slips in early March 2026 from the custodian directly.

Are you wondering how to best prioritize contributions across various registered plans or would like to have your financial plan updated to include these recent changes? Please reach out to your QV Investment Counsellor to discuss your personal tax situation in detail. We are always happy to work collaboratively with you and your tax professional to help you achieve your most optimal outcome.