Spoiler alert – it isn’t Trump or his policies. Or how the stock market reacts. Or what he does next. But you already knew that.

In life, one of the most important lessons we can learn is the difference between what is within our control and what is not. After all, focusing on things we have no control over only leads to anxiety, stress and frustration, but sometimes it is easier said than done.

April was a good reminder about just how much is out of our control. We live in a world where information is processed faster than ever and where a single social media post or news headline can send markets soaring or plummeting in either direction. It can be a real challenge to keep your emotions in check.

Here are three things that are within your control that can be helpful to focus on while investing through these time periods:

1. Your Perspective – Keep it long-term

While it’s tempting to think successful investing is about reacting quickly, spotting trends, trading in and out, or timing the next big move, history shows that true wealth is built by thinking long-term and staying invested.

If your account is down in value today or tomorrow, ask yourself, “Does it really matter all that much?” Nobody likes to lose money, but unless you need to withdraw the entire amount to fund a very specific goal, the answer is likely not. It’s even more likely you have time to recover, or better yet, an opportunity to buy more. And even if you are needing to access some of your portfolio for income, it’s probably to fund your retirement, which again, is long-term and likely accounted for in your asset allocation.

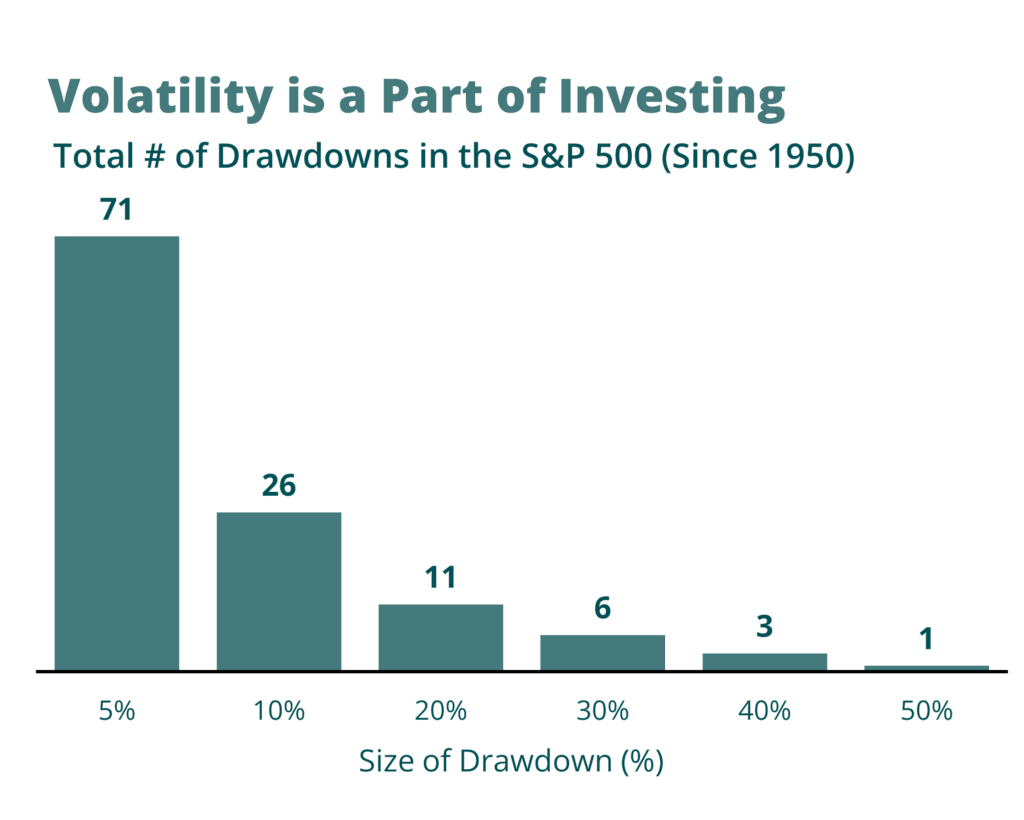

Over the last century, despite wars, recessions, terrorist attacks, pandemics and financial crises, the S&P 500 has averaged a return of roughly 6-7% per year after inflation. Staying invested through these highs and lows gives you the best opportunity to capture long-term growth. Successful long-term investors know that volatility is normal and think of it as ‘the price of admission’ to earning higher long-term returns.

Source: Exhibit A, FactSet Research Systems Inc., Standard & Poor’s

For example, the chart above highlights the frequency and scale of that ‘price of admission’ in the S&P 500 since 1950, emphasizing that market volatility – whether large or small – is an inevitable part of investing.

Maintaining a long-term perspective and staying focused on your investment goals can help you navigate periods of market decline. Avoiding panic-selling during market downturns, diversifying your portfolio to reduce risk and understanding that volatility can create opportunities for growth are all key to weathering these challenging periods.

For those of you who are long time QV clients, you know that downside protection is our hallmark. It makes it much easier to stay invested when your portfolio is down considerably less than the broader markets. While other investors are panic-selling, QV is taking advantage of opportunities, born out of volatility, on your behalf.

2. Your Asset Allocation – It Matters

As a quick refresher, asset allocation is the process of dividing an investment portfolio among different asset classes such as stocks (equities), bonds (fixed income), cash or cash equivalents, and sometimes even alternative assets like real estate or commodities. The primary goal is to balance risk and reward by adjusting the proportions of each asset class based on an investor’s personal financial goals, risk tolerance and investment time horizon. By diversifying across these classes, you can reduce the overall volatility of your portfolio, as losses in one class may be offset by gains in another.

Asset allocation is widely considered one of the most important decisions in investing. Studies show that asset allocation1 is the single largest determinant of a portfolio’s long-term return variability, often accounting for more than 90% of the performance differences among portfolios.

Here’s the good news: it is completely within your control. For instance, do you want less risk? Easy, own less stocks. Want a higher return? Increasing your allocation to smaller companies with higher growth potential could be a good option.

You can set and adjust your asset allocation at any time, but most often it is set with your long-term goals in mind, and it’s important to be in the right range. It’s also critical to review when you are nearing retirement and during any other life period or milestone that may warrant a material change. Financial plans or projections use certain return assumptions and, as we’ve outlined, your asset allocation will play a large role in your long-term investment returns.

If you find yourself questioning the level of volatility in your portfolio during a downturn, it is always a good idea to review why you decided on your chosen asset allocation in the first place. This can help bring peace of mind and allow you to shift your perspective to what matters most – meeting your long-term goals.

Then, there is the practice of rebalancing. It is important to regularly review and rebalance your portfolio’s asset allocation based on the market backdrop and the current opportunity set. This helps preserve capital by locking in gains from outperforming assets, while redeploying capital into better opportunities that offer more compelling future growth potential. This disciplined process can enhance returns by systematically buying low and selling high, rather than chasing market trends. We execute this process for all of our clients at QV.

And if along the way you feel like you have the right allocation and decide to do absolutely nothing – well, you’re in good company.

“Sometimes the best move is to do nothing at all—allow the market to present you with clear opportunities.” – Warren Buffett

3. Your Savings/Spending Rate – For real.

It may not feel like it these days, but yes, this is also something you can control.

The amount you save regularly is the most significant factor in building wealth, especially in the early and middle stages of your investment journey. Period. Even if you use every trick in the book to optimize your asset allocation, a low savings rate can severely limit your portfolio’s long-term value. Conversely, a higher savings rate can compensate for more conservative investment choices or periods of lower market returns.

While market returns can be unpredictable, and asset allocation tweaks may only modestly affect outcomes, increasing your savings rate is a reliable and controllable way to boost your portfolio’s value. For example, increasing your annual savings by 20% can have a greater positive impact on your final portfolio value than shifting to a more aggressive asset allocation, while maintaining your portfolio’s current level of risk.

Of course, setting a monthly contribution amount has many advantages but, during a market sell-off while prices are down, increasing the amount you save can go even further by taking advantage of ‘stocks on sale.’ It’s like stocking up on your favorite wine on Black Friday and tucking it away in the cellar. Maybe you spend a little more at once, but you know it’s going to pay off in the long run. During periods of decline, consider making an additional lump sum contribution or increase your monthly amount.

The same can be said for your spending level. By reducing the amount you withdraw from your portfolio, especially during lengthy market declines, you can lower the drawdown on your portfolio. However, with proper planning and an asset allocation that includes fixed income, this is usually not necessary, but it is something that is within your control.

In summary, it’s best not to focus on things you can’t control. Instead, think about some of the things you can, the things that matter. By keeping your perspective long-term, monitoring your asset allocation and increasing your savings rate, you can use volatility to your advantage.

1. Brinson, Hood and Beebower, Financial Analysis Journal – 1995.

Determinants of Portfolio Performance | CFA Institute Research and Policy Center