The Shifting Sands of Market Leadership

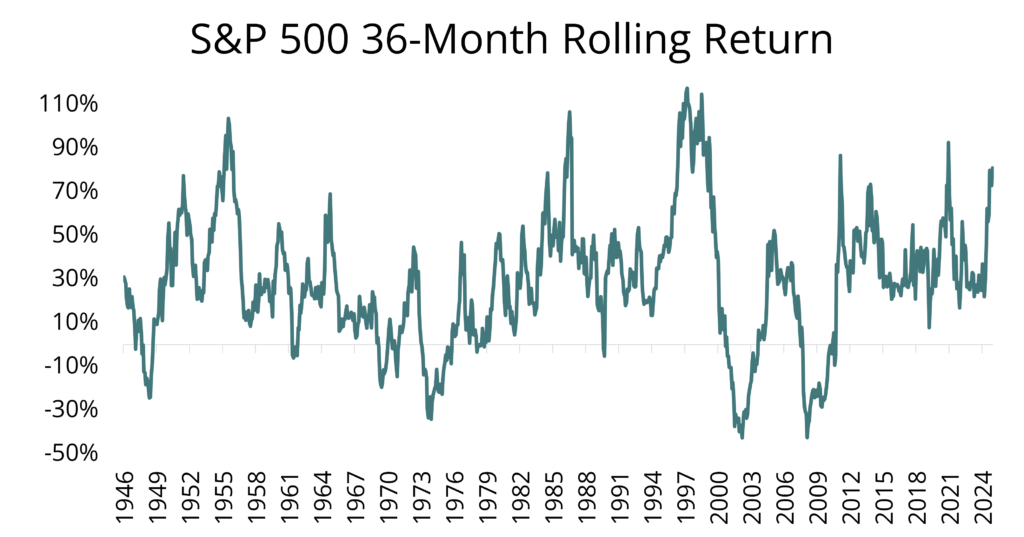

Beyond the disruption of tariffs and trade wars, the factors driving equity returns in 2025 looked similar to recent years on the surface. Global stocks generated a third consecutive year of double-digit performance as the S&P 500’s 36-month return reached a level only surpassed in five other instances in the post WWII era. Index returns remained highly concentrated with technology stocks accounting for 44% of the S&P 500’s returns, while materials (gold) and financials contributed 72% of the TSX Composite’s returns. Meanwhile, the average company in the S&P 500 underperformed the broader index for the third year in a row, cumulatively underperforming by 43% since 2022.

Source: QV Investors, Capital IQ

However, beyond the continuation of strong, concentrated equity returns, major shifts in market leadership during the year appear to suggest an inflection in the market’s trajectory.

The artificial intelligence (AI) narrative shifted violently from the Magnificent 7 to the proverbial ‘picks & shovels’ providing hardware and equipment necessary to build AI data centers. Alphabet and NVIDIA were the only businesses among the Mag 7 that outperformed the S&P 500, while the others lagged as investors weighed slower earnings growth momentum and immense capital expenditures which have pushed the free cash flow yield on the S&P 500 to the lowest level since 2001. Meanwhile, memory chip providers such as Micron and long-term QV Global holding Samsung Electronics surged 240% and 120% respectively in response to surging demand for chips required to power AI data centers. The spike in AI related capital spending extended to industrial businesses as well, with power generation equipment manufacturers such as Caterpillar and QV Canadian large cap holding Finning’s shares rising 60% and ~100% respectively. While the return on all the capital being spent to advance large language models remains uncertain, the required data center investment has durably raised demand for the equipment required to build them. That Finning traded at just ~10.5x earnings and Samsung traded near 1x book value at the beginning of 2025 underscores that there are more ways to benefit from the fervour in AI than chasing the most expensive companies being touted in the daily news. It also shouldn’t go unnoticed that after years of pulling the S&P 500 higher, the biggest of the big tech companies ceded market leadership in 2025.

America (Not) First

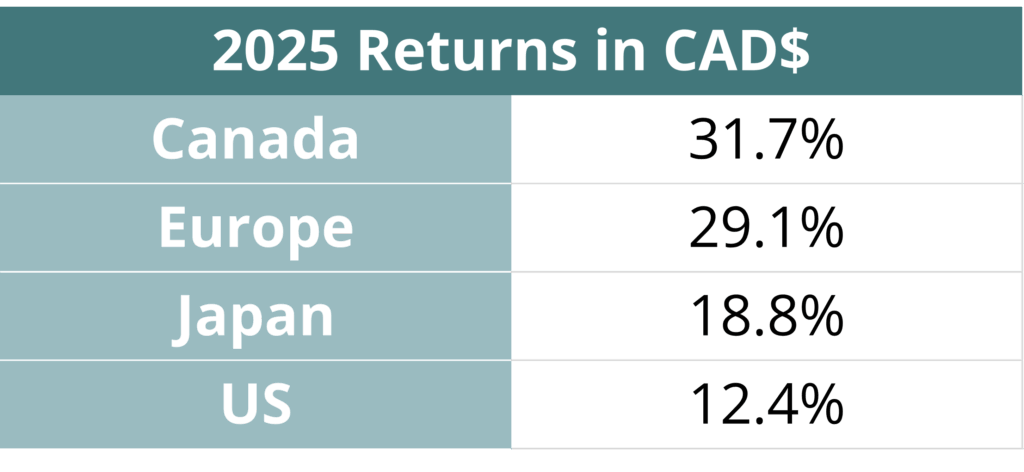

The shift in market leadership away from the U.S. was another meaningful development in the year. Canadian and international markets meaningfully outperformed the S&P 500, led by decidedly ‘old economy’ sectors like financials, industrials and materials, where returns were driven by falling interest rates, AI data centers, defense and stimulus spending and a surge in precious metal prices.

Source: RBC, QV Investors

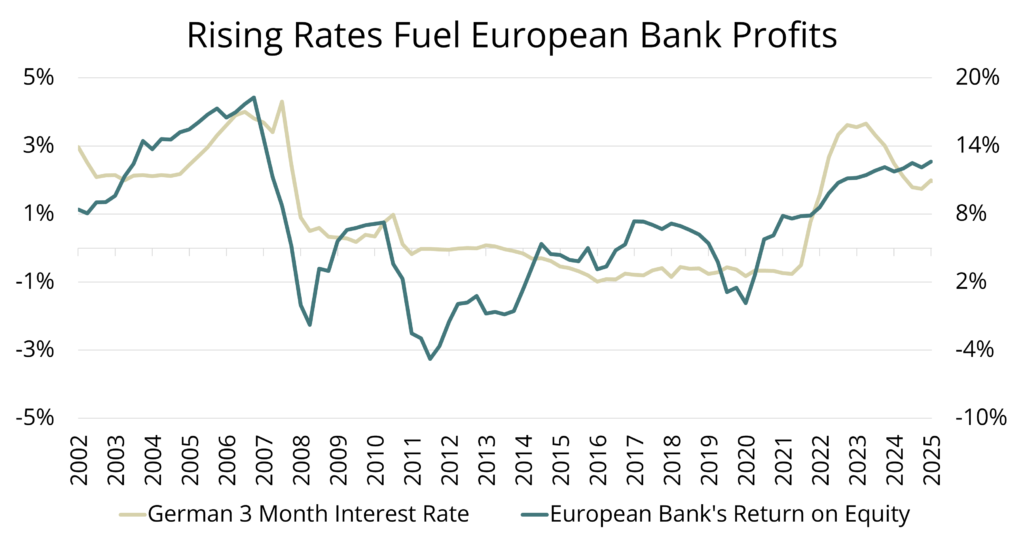

In Europe and Japan, the re-emergence of positive interest rates has re-ignited profitability in the languishing banking sector in recent years. European financials rose 65.7% in 2025 as valuations re-rated upwards alongside higher earnings per share. In Canada, falling central bank rates caused the yield curve to steepen. While the Canadian economy remained tepid, bank stocks rose 43.4%.

Over the last five years, European financials’ 111.5% return has trounced the performance of the S&P 500’s 82.3% despite the ascent of Big Tech. In a stock market of high valuations reliant on continuing technology stocks’ earnings growth, the results of European financials are yet another potent reminder of how low starting valuations can lead to attractive outcomes if business fundamentals begin to improve and that the next best opportunity may lie beyond the areas of the market most in vogue with investors.

Source: Bloomberg, QV Investors

The outperformance of Canadian and international markets was also supported by rising gold prices (+64%) and a falling U.S. dollar (-9.4%) during the year, as global central banks bolstered their gold reserves and as individual investors sought out gold’s status as a store of value in response to geopolitical and trade concerns, as well as U.S. deficit levels which risk financial repression and currency debasement.

Convergence and Coalescence, Divergence and Decoupling

For investors, could the ascent of commodities, financials and old economy stocks beyond the U.S. be more than just signals about latent inflation or insecurity in a more volatile geopolitical arena? Beyond late-stage cyclical overtones, they appear to be indicative of a bigger shift in the polarity of performance leadership in a world adjusting to a new geopolitical and financial reality. Higher commodity prices spur capital expenditure, fill the government coffers of exporting countries and bring more revenues to adjacent and downstream businesses. Higher bank profits support lending and capital formation. Infrastructure and defense driven stimulus require raw materials and incremental demand for labor, driving new investment in the real economy. Together, these forces work to reinvigorate cash flow growth in industries beyond the nexus of software and silicon which have dominated equity returns over the prior decade, potentially forcing the long dormant gears of mean reversion to grind onward once again.

While U.S. equities have broadly outperformed other international stock markets over the long-term, owing to the dynamism of the U.S. capitalist system, the S&P 500 has also endured sharp, sustained periods of weak performance which tend to arise during U.S. dollar bear markets and commodity bull markets.

The U.S. dollar just endured its worst year in nearly a decade. Commodity prices like gold and silver just had their best year since 1979. While the U.S. dollar is likely still a safe-haven in a risk-off environment, further weakness in the dollar may accompany further U.S. underperformance. At the same time, the S&P 500 has historically enjoyed its strongest returns in periods of rising market concentration, while periods of diffusing concentration have coincided with weaker market returns.

Source: Morgan Stanley, FactSet and Counterpoint Global

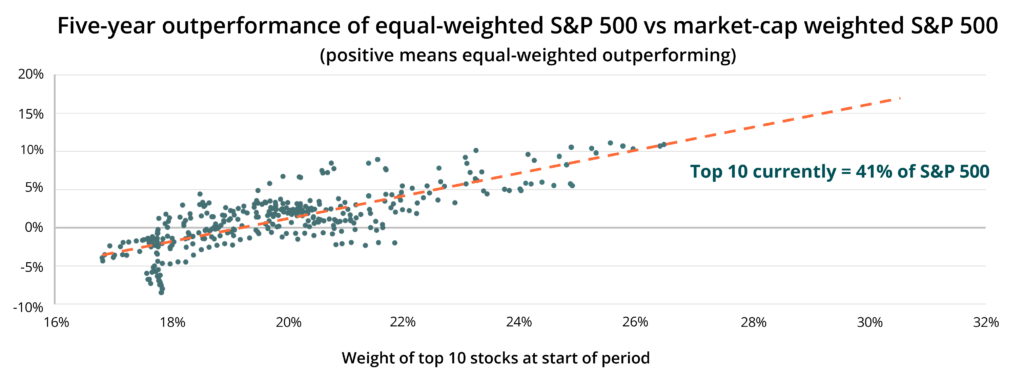

The S&P 500 is now the most concentrated in history, while still trading at a valuation historically associated with weak future returns. As the below chart shows, the more concentrated the index is, the better the average U.S. stock has tended to perform relative to the broader S&P 500.

Source: Schroders, LSEG Datastream, S&P. Data from 1989-2023.

For over a decade, the rest of the world has been very cheap relative to the U.S. stock market due to superior U.S. earnings growth. But what happens if this advantage begins to deteriorate, particularly with technology stocks?

Is it purely coincidence that commodities, financials and industrials are rising in a period marked by rising capital expenditure, fiscal stimulus, nebulous inflationary trends and higher real interest rates, while expensive technology stocks’ outperformance may be diminishing? Are these phenomena not two sides of the same coin? Do the coalescence of these factors not suggest a schism in the status quo of the prior decade?

The bulk of institutional capital allocated to public equities over the last decade has flowed to the U.S. and big tech at the expense of the rest of the world. This has largely been the right decision, but at some point, did intelligent allocation eventually become supplanted with trend following and the confirmation bias of trailing returns? After 17 years of a mostly uninterrupted secular bull market, an entire generation of individual investors have been conditioned to believe that equities only rise and that passive investment in the S&P 500 is a surefire path to strong returns. Over the long-term this logic isn’t unsound. But do today’s investors really understand what the ‘long-term’ may imply? Would this hypothetical investor’s resolve be so intact if it was 1982 and they had just endured a decade and a half of negative real returns in the S&P 500? Too often, the shackles of the recent past are chains too heavy for many investors to escape as they envision the future. If there is indeed a shift taking place in the direction of equity markets, it may yet take time, but the effects are likely to be profound and the disillusionment and opportunity cost for many will be large.

A Brave New World

Where then are the opportunities? Broadly expensive markets have compressed the availability of overtly attractive opportunities, particularly from a risk-adjusted basis, but valuable pockets exist in an environment where the diffusion of valuations remains wide.

Defensive areas of the market like healthcare and consumer staples trade at historically low multiples to the broader market. Many European cyclicals as well as smaller capitalization companies globally continue to trade at low multiples of earnings alongside depressed profit margins in many cases. The risk of many of these areas is often below market earnings growth. But looking out 3-5 years, arguments can be made for very reasonable returns with conservative assumptions.

The move in precious metals is well under way, but we have just seen industrial metals move to new highs. Could there still be opportunity here? Often the providers of tools, or the companies that manufacture raw materials into value added products and subsequently pass through the cost increase of the underlying metal, benefit as well. It’s not a coincidence that during the inflationary spiral of the 1970’s industrials were among the strongest performing sectors after gold and energy stocks.

Since the summer of 2022, there has been a recession in transport volumes among trucking companies and railroads. Today, QV holdings such as Canadian National Railway and Union Pacific trade at reasonable valuations and near record discounts to the broader market. As shipment volumes improve over time alongside economic growth, the ability to leverage volume and pricing power over a fixed cost base provides both reasonable long-term growth potential in addition to continuing capital returns to shareholders.

Following strong performance in 2021 and 2022, energy stocks have underperformed the S&P 500 by 76% in the last three years. Free cash flow remains strong despite low oil prices, balance sheets are strong and management teams are broadly focused on returning capital to shareholders and consolidating peers. The QV Canadian Small Cap Strategy recently purchased shares in Topaz Energy Corp., an energy royalty and infrastructure business, trading at an attractive 7% free cash flow yield using conservative assumptions which the team feels can grow organic production at a mid-single digit pace in coming years. While outcomes for energy are often at the mercy of oil prices, low current commodity price expectations provide optionality for a future scenario where demand could outweigh supply.

In the last few years, rising discount rates alongside slower future earnings growth potential has led to severe valuation compression for many previous high flying quality businesses. While there can always be a risk of finding more pyrite than gold, particularly given that the requisite fall in valuation is often justified by lower growth prospects, there remains much fertile hunting ground today. For example, in March of 2025, the QV Global Equity Strategy purchased Dollar General, the largest discount retailer in the U.S. at just 14x earnings, after the shares had declined ~70% and earnings had fallen by 47% following what we saw as fixable cyclical and operational challenges in an otherwise resilient franchise with many years of future growth. In the time since, management has taken steps to improve growth and profit margins and the shares have risen ~80%, showing that even in expensive markets, there are always opportunities to be found.

These are but a few examples of areas where there may yet be opportunity beyond the largest and most expensive areas of the broad indices. Of course, opportunity isn’t always the market price offered today. Future unexpected events will inevitably create dislocations between equity prices and fundamentals, as April’s Liberation Day crash did. Given tight corporate spreads, QV’s fixed income strategy continues to be managed conservatively with high quality corporate credits and a healthy allocation to government bonds while still generating a yield above stated inflation. QV’s fixed income strategy provides both ballast in client portfolios and capital at the ready to be reinvested into equities when the opportunities of tomorrow arrive.

An Uncertain Path Forward

2026 may yet prove to be another record year. Central banks have lowered interest rates, the benefits of the One Big Beautiful Bill are expected to add 0.9% to U.S. GDP1, and global corporate earnings are expected to rise 14%2. Regardless of the near-term progression for stock prices in the coming year, it’s becoming increasingly likely that:

- High global stock market valuations strongly imply the forward environment will be characterized by lower future returns, more volatility and potentially negative returns in the U.S. after accounting for inflation in future years.

- After many years of rising market concentration, the market may be moving away from a monolithic structure where returns are dominated by a few large businesses to one of greater dispersion.

- Investors dogmatically beholden to factors like growth or hindsight bias will likely be disadvantaged in favor of opportunism, dynamism and margin of safety.

- This environment will benefit active investment over passive investment, particularly in the U.S. We believe it will play to QV’s risk-adjusted approach.

Performance

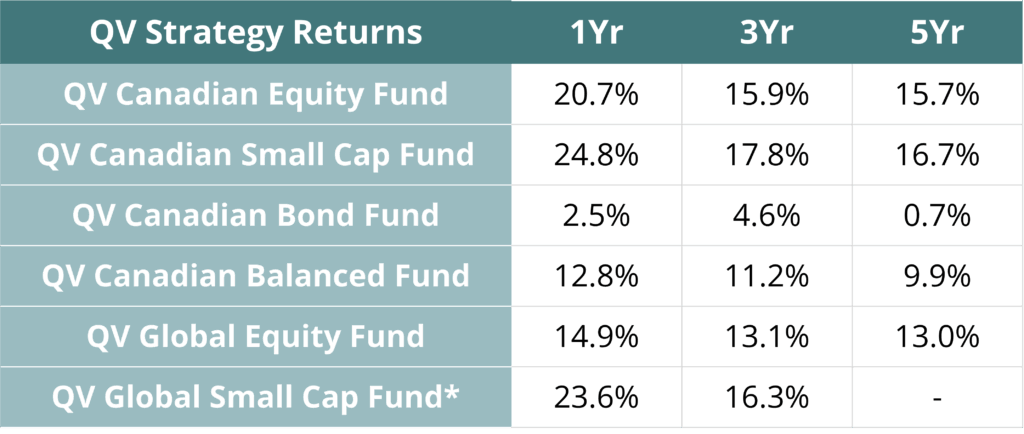

QV’s strategies generated reasonable returns in 2025 but the overwhelming contribution of precious metal stocks to Canadian stock market returns led to our Canadian strategies lagging their benchmarks, as has occasionally happened in bull markets for gold. This is despite strong returns in the QV Canadian Small Cap Strategy supported by five holdings being acquired at an average 41% premium, as well as a 27% return from financials businesses owned in the QV Canadian Large Cap Strategy at an average weight of 22.8%.

The QV Global Equity Strategy fell just short of its benchmark due mostly to weakness in two U.S. based healthcare insurers whose profits were impacted by regulatory changes and temporary mismatches between premiums and claims inflation, while returns were greatly aided by robust performance in businesses benefitting from the rise of artificial intelligence including Samsung Electronics, Alphabet, Alibaba and Tencent.

QV’s Global Small Cap Strategy meaningfully outperformed during the year, returning 23.6% as it benefitted from strong returns among a select number of high-quality consumer discretionary holdings.

Our fixed income strategy marginally underperformed the Canadian bond index as long-maturity bond yields rose despite the Bank of Canada cutting rates during the year. Given extremely tight corporate credit spreads, the fixed income team continues to prefer high quality, shorter duration corporate credits as well as government bonds to provide a reasonable yield and stability as part of a balanced asset mix.

Thank-you for your ongoing trust in QV, we wish you all the best in 2026.

Source: QV Investors

Note: Returns are in CAD, gross of fees

*A five-year figure is not available, as the inception date of the QV Global Small Cap Fund was April 1, 2021.