Cloudy with a chance of showers

The economic picture is growing hazier with each new tariff announcement from the Trump administration. The communication has been dizzying to say the least, disrupting global trade and contributing to market volatility. Overall, the tariff trend has been broader, larger and more aggressive than originally expected. Cost cutting in the U.S. public sector is also a concern as government spending has typically been a reliable contributor to economic growth through a market cycle. Not only are government job cuts likely to continue, but the cloud of uncertainty is unsettling consumer and business confidence, with risk of sifting through into weaker economic growth.

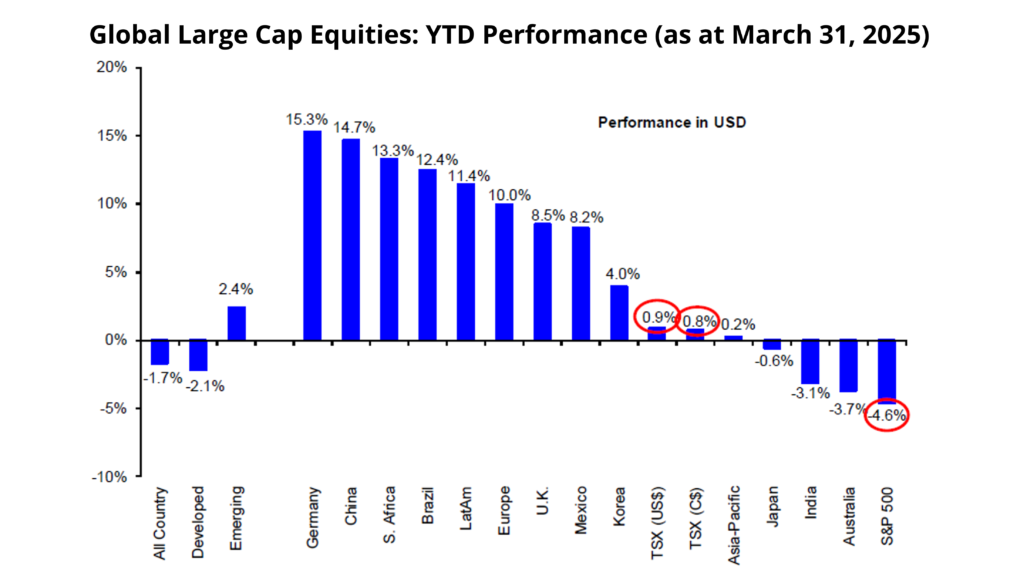

Markets do not like uncertainty. They seek the simplicity of persistent earnings growth. Typically, when new information results in a lower (higher) earnings stream, markets reprice lower (higher) to reflect the new reality. The first quarter saw a bifurcated market with the S&P 500 returning -4.3% in USD. The TSX Composite returned +1.5% in CAD, and cheaper overseas markets meaningfully outperformed in the period. This is a reversal of the trend where ‘U.S. exceptionalism’ pushed its stock market to new highs, leaving others in its dust. Even the previously untouchable Magnificent Seven experienced a -15.7% (in USD) correction in the first quarter. In Canada, the materials sector posted the strongest growth at +19.9%, significantly outperforming all other sectors, as gold reached a new record high and pushed the TSX into positive territory for the period.

Source: Scotiabank GBM Portfolio Strategy, Bloomberg

Bonds held in fittingly as Canadian bond yields moved lower, marginally lifting bond prices in Q1. The FTSE Canada Universe Bond Index returned +2.0% (in CAD) in the period. The Bank of Canada (BoC) lowered its policy rate twice in the quarter to 2.75%, a far cry from the 5.0% peak just held nine months ago, citing monetary accommodation was necessary to provide economic support during this uncertain time.

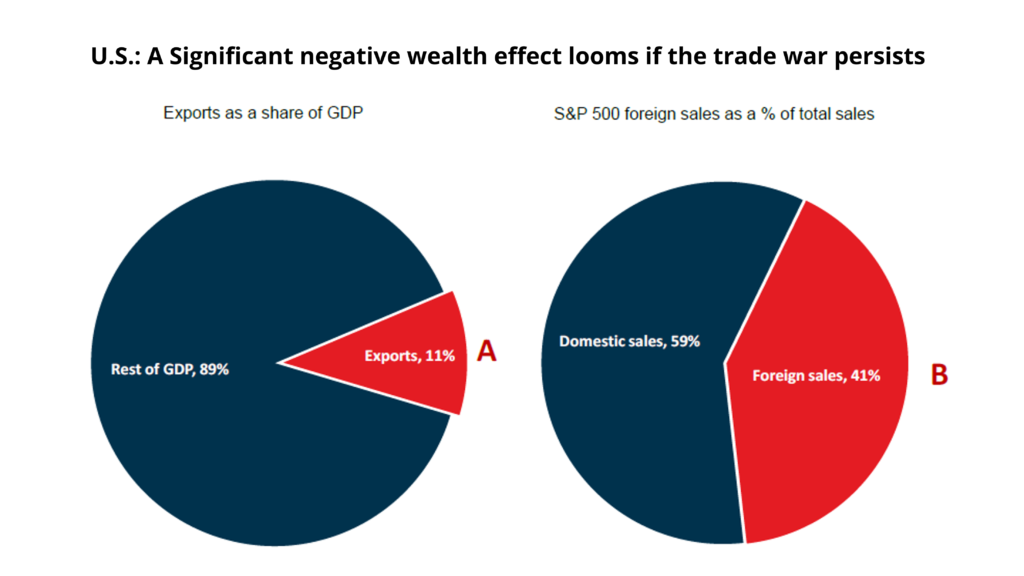

Following the S&P 500’s outsized returns in both 2023 and 2024, a period of more normalized market returns is not abnormal. However, greater forces suggest that the current market disruption should not be dismissed as just a knee jerk. Spillover effects from this major shift in U.S. trade policy may lead to reduced capital investment and lower consumer spending. In turn, this may pressure corporate earnings lower as consumers account for the majority (roughly three-quarters) of U.S. GDP. Lower corporate earnings expectations are likely to move stock valuations lower, leading to a vicious cycle where a negative wealth effect could result in a further pullback of consumer spending. While Washington attests that exports only account for 11% of GDP – and therefore, the U.S. economy is largely shielded from the consequences of a trade war – foreign sales account for 41% of aggregate S&P 500 revenues. This suggests that, if a trade war were to persist, both investors and households would be negatively impacted, in contradiction to the notion that the U.S. is immune.

Source: NBC Economics and Strategy (data via BEA and FactSet)

An uncertain outlook, eh

Canada is in a tough position. Tariffs are negative for our small and open economy. While the permanence of these levies is a key and unpredictable variable, economists estimate anywhere between a -1.0% hit to Canadian GDP for a temporary war and up to a -4.5% impact in a broader based and drawn-out scenario. Nonetheless, it is a negative shock to Canada, which is disappointing as economic activity was showing some resilience in the months leading up to these tariff announcements.

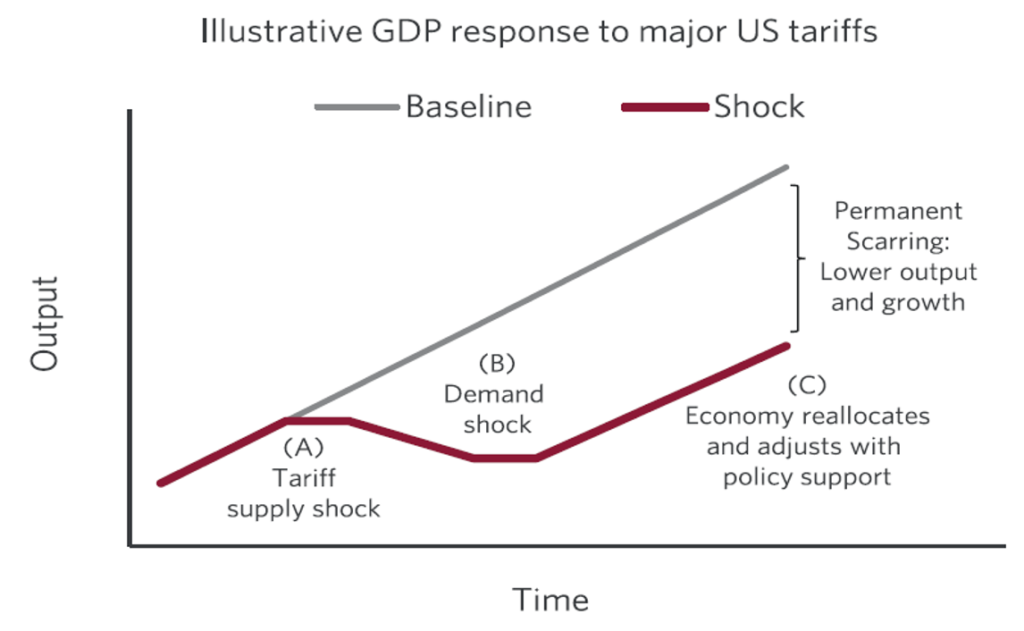

The below chart illustrates the permanent damage that a tariff shock can have on economic output. Over time, an economy will adjust to a new reality as resources and productive capacity are reallocated and growth eventually returns. But this accompanies a permanent loss of economic output.

Source: CIBC

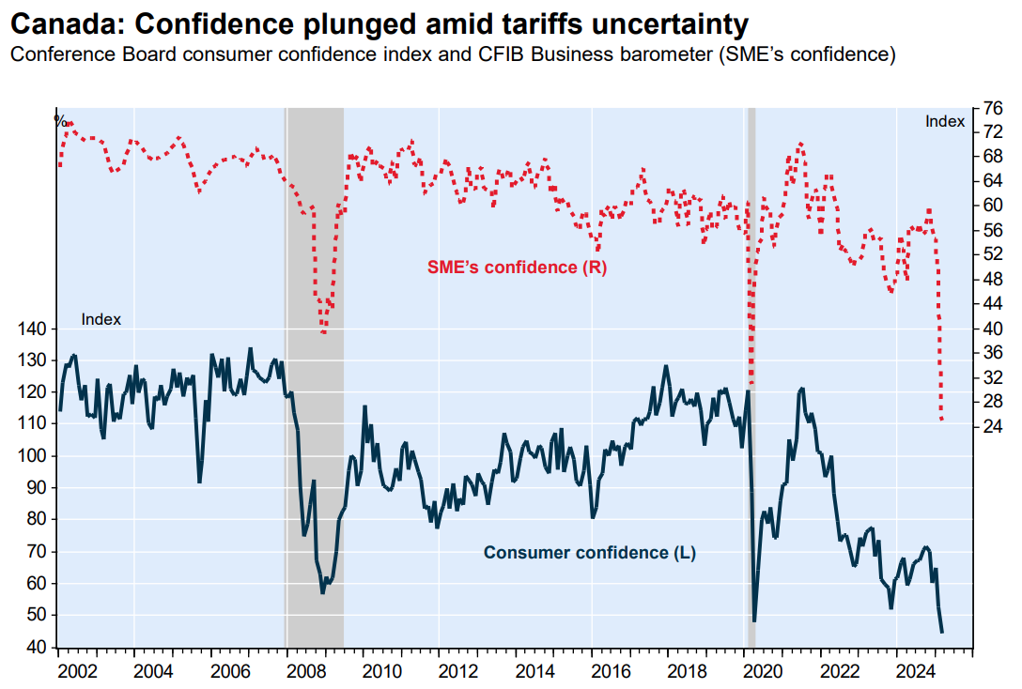

Canadian households and businesses are already showing signs of wear from this trade war and are clearly concerned as confidence indicators have declined to multi-decade low levels. At current levels, hiring plans and capital investments are at risk of being curtailed. This uncertainty has the potential to bleed into other areas of the economy and disrupt Canada’s economic momentum. It is difficult to see through the fog at this early stage, as the true size and duration of these tariffs remain a question mark.

Source: NBC Economics and Strategy (data via Conference Board of Canada and CFIB)

Following the April 28 federal election, new leadership in Ottawa will have their work cut out for them, as they plunge into trade negotiations with the hope of instilling business confidence to keep the pipeline of capital investment full and free flowing. Our hope is that cooler minds will prevail over time as they often do. Canada remains home to some of the best businesses in the world, and it is our intention to buy more should the market’s emotions drag valuations lower.

Potentially large reversals to be aware of

As long-term investors, we do not believe the world moves in a straight line. When societal, political and market forces have leaned so far on one side, pressure tends to build to a point where it can no longer be contained, and eventually the release of pressure propels a redirection out and away. Unlike in the world of physics, the timing of such an inflection point in society and the markets is difficult to predict with accuracy. But it is this awareness and preparation that underlies our risk-managed approach.

Recent events, such as the rise of populism and this trade war, are evidence that the era of globalization reached a breaking point some years ago and is now reverting the other way. The economic concepts of free trade and international comparative advantages have been succeeded by isolationism in manufacturing independence and border controls.

Germany’s March 4 announcement to re-militarize and substantially increase deficit spending marks a major divergence in post-World War II domestic policy. The world is quickly realizing that it can no longer rely on the U.S. to serve as its de facto world police. Other nations are likely to follow suit.

The onshoring of supply chains is another well documented deglobalization trend, as the pandemic forced nations to reassess their heavy foreign dependence. The point being that it is important to maintain an alertness and openness to a change in the status quo, especially when extremes are at hand.

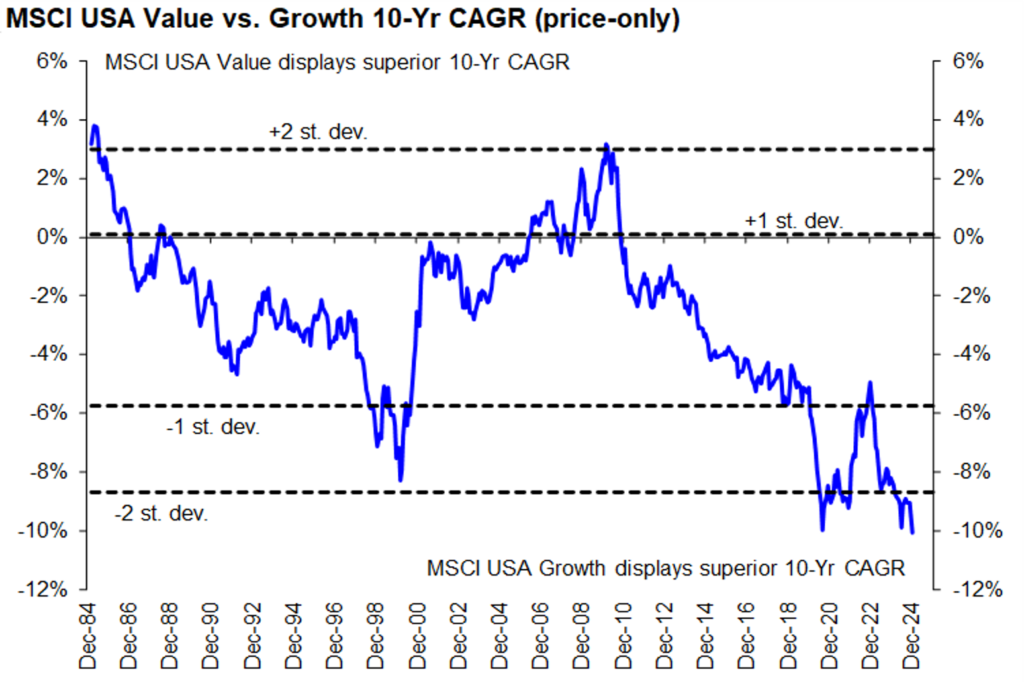

In markets, we have long written about the extreme between value and growth styles. The chart below highlights how growth stocks have significantly outperformed value stocks over a rolling ten-year period. We saw a post-pandemic pivot, with value outperforming for a short while, but this has reverted to a new nadir. This has reached an extreme level in our opinion, where a reversal could be a powerful tailwind for those positioned appropriately.

Source: Scotiabank GBM Portfolio Strategy, Bloomberg

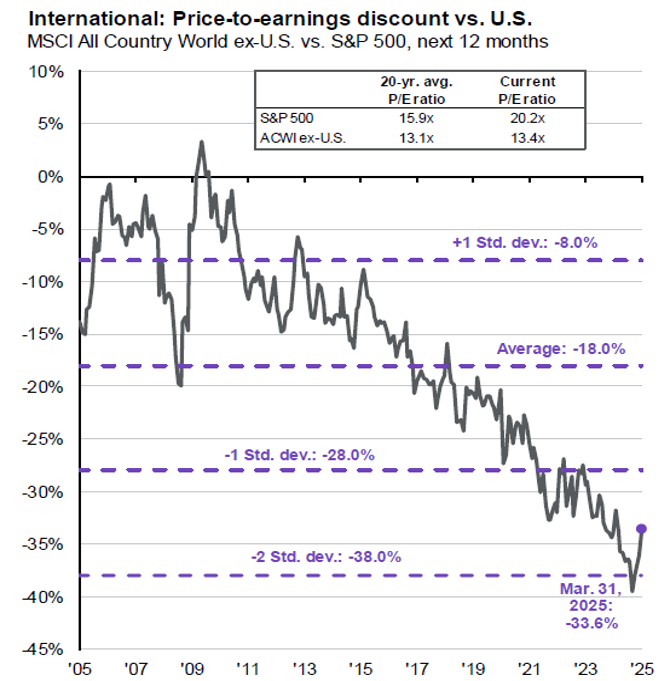

The U.S. exceptionalism theme in recent years has been quite impressive to say the least. This however has led to an extreme valuation discount between the S&P 500 and developed global markets ex-U.S. The extreme of -38.0% seen at the end of 2024 has since retraced to -33.6% in Q1 but remains wide. This is another market divergence and one where we could see further normalization, as the chart below points to disjointed sentiments between U.S. and non-U.S. equity valuations. Our global equity teams have been uncovering attractively valued businesses outside of the U.S. market for some time now, as sentiment remains downtrodden in most international developed markets.

Source: FactSet, MSCI, Standard & Poor’s, JPM Asset Management. Guide to the Markets – U.S. Data are as of March 31, 2025

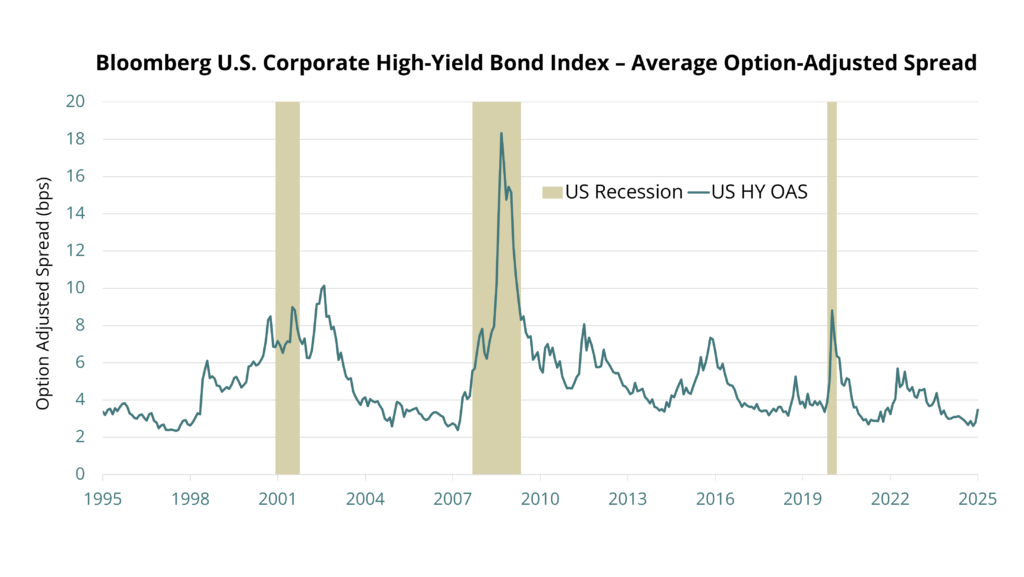

In debt markets, corporate credit premiums have reached historically rich valuations (narrow credit spreads). Even corporate credit premiums issued by non-investment grade companies, otherwise known as high yield, have traded to a level that does not adequately price in challenging economic conditions ahead. Furthermore, such narrow valuations have historically been a launchpad for credit premiums to widen from. Our bond strategy has steadily reduced corporate credit exposure as valuations have grown richer. We have upgraded quality through government duration and are awaiting a more attractive opportunity to be buyers of corporate credit.

Source: Bloomberg, QV Investors Inc.

Be aware of what is priced in

Valuations not only reflect current market conditions, but also future expectations and investors’ willingness to pay for a dollar of earnings – or in the case of credit markets, the rate a lender is willing to lend at. This makes valuations dynamic, encompassing both logic and emotion, and subject to repricing when earnings expectations, sentiment or market conditions change.

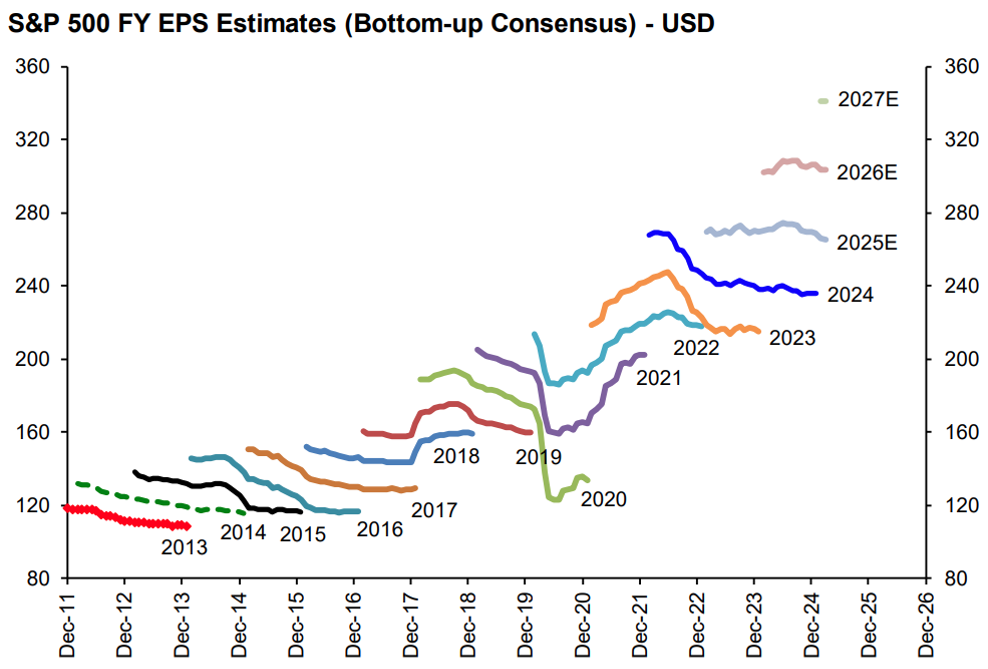

Earnings expectations for the S&P 500 at the end of Q1 were quite optimistic, implying growth of 12.4% y/y in 2025, 14.4% y/y in 2026 and 12.4% y/y in 2027. These growth rates underpin an expensive market as the price-to-earnings ratio of the S&P 500 ended Q1 at a historically elevated level of 20.3x. As shown in the below chart, this is one of the highest valuations of the last 38 years and exposes the market to a repricing event should earnings growth expectations disappoint.

Source: Scotiabank GBM Portfolio Strategy, LSEG

Source: Scotiabank GBM Portfolio Strategy, LSEG

The expectations priced into starting valuations can either act as a tailwind or headwind for future returns. Our risk-managed approach to investing keeps us attentive to the growth and credit trends and associated valuations of our investments. We aim to benefit from valuation expansion while minimizing the impact from valuation contraction that occurs when lofty expectations disappoint.

Built for this

Our investment strategies are not the market. QV’s strategies are constructed business by business, security by security, through the consistent investment process and philosophy that our firm was founded on. It is important to separate the market from our portfolios, especially during an uncertain time like this.

Our investment teams have been consistently upgrading the quality and defensiveness of our strategies, while managing valuation risk and minimizing credit risk. Our strategies offer a prudent balance of defense, as well as a healthy allocation to opportunities, that we expect to earn a durable risk-adjusted return. Our teams have been emphasizing businesses that are somewhat insulated from tariffs, such as those earning a high percentage of contractual cash flow. We also own businesses that have sensible levels of leverage or even net cash positions. Our balanced strategies are positioned conservatively as well. There will naturally be winners and losers as we move deeper into this multispeed world, and our bottom-up focus will help identify those enduring businesses that are led by management teams that have navigated turbulent times before.

Our teams have been proactively screening and preparing for market volatility. For long-term investors, periods of market stress can create attractive buying opportunities where valuations detach from business fundamentals. QV’s investment principles were built for these uncertain times that we find ourselves in today. Being prepared and sticking to our process puts the odds in our favour.