“Peace be with all of you” were the first words (in Latin) of the ascendant Pope this past week in Rome. This age-old sentiment reflects a current and future hope of security, harmony and tranquility for all – one which, irrespective of background, is a sentiment that many would echo personally. However, in the context of financial markets, 2025 has been anything but ‘peaceful’, reflected through rising volatility and even ripples or waves through the typically sedate “risk-free” U.S. treasury market. Despite the volatility, investing matters at QV have been business as usual, partially due to another Latin saying ingrained in our team: “If you want peace, prepare for war.”

In this Insight, we will share how preparation pointed in the direction of long-term resilient returns for clients has supported our composure in the midst of this economic or “tariff war” state of the world we find ourselves in.

Preparation on a portfolio level – Continuous Improvement

Our belief is that portfolio management actions consistently directed towards improving the strategies’ Quality, Value, Growth & Diversification — the foundational investment principles our firm was built on — will generate resilient returns, evident since inception. You may be thinking: “Beliefs and intentions are nice – but they are also abstract. What does this mean day-to-day or year-to-year in the strategy, and how can we maintain our composure?”

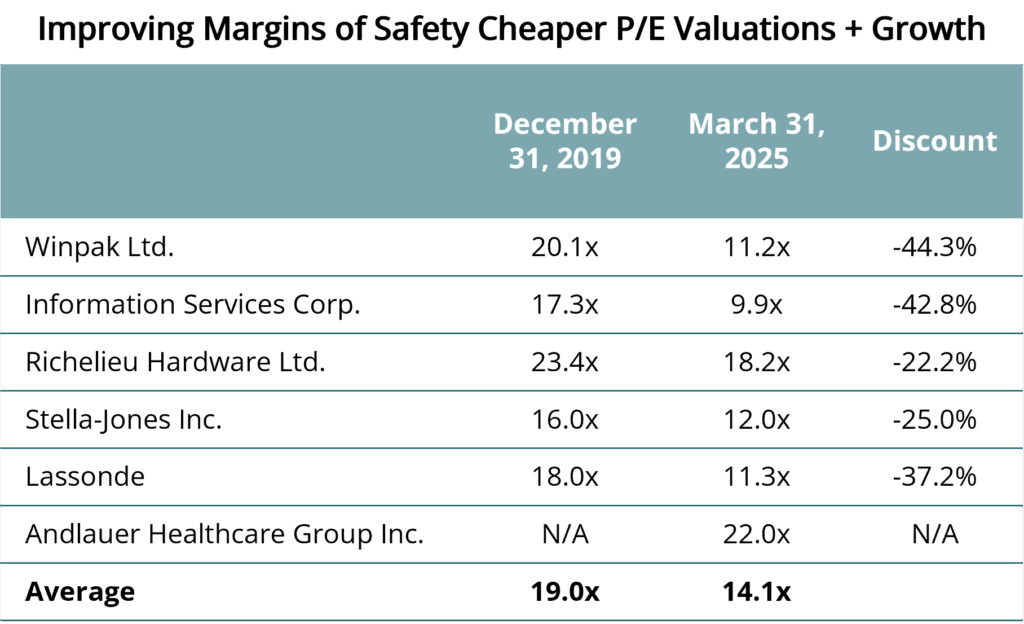

The QV Canadian Small Cap Strategy has been focussed on iterative, continuous improvement since 1996. In these past 5 years, irrespective of arbitrary ‘sector’ classifications, the strategy’s exposure to quality ‘Steady Eddy’ businesses (see chart below) has methodically increased, significantly advancing economic diversity while paying increasingly lower valuations and maintaining comparable to better underlying growth prospects. In our assessment, the foundation for prospective resilient returns in the next decade has improved and is more attractive, inclusive of a risk-adjusted outlook. Importantly, each holding is continuously stress tested, prior to and during the holding of an investment, for both ‘good’ and ‘bad’ conditions. As a result, we typically are prepared to invest through a range of different conditions as they arise, and we are often increasing allocations while others focus on shorter time horizons and macro conditions.

Source: Capital IQ & QV Investors

In conjunction with company specific shifts, the strategy’s P/E has shifted from 17x P/E five years ago to 13x (as of March 31, 2025), while also improving the 4-year ROE of the strategy, which has shifted from ~9% to over 14% over the same time frame.

Preparation on a holding level – Optionality and Focus

Shifting from a strategy-level view to individual holdings, the components of our strategies are built to be prepared for the unknown future states and probabilities of the world. We have much due respect for entrepreneurs on the front lines, operating in an extremely uncertain and ambiguous outlook of the upcoming business conditions and customer demand. Fortunately, those on the front lines of businesses in our strategies are also committed to preparing for success in various future market environments.

An example of this is our holding Lassonde, a leading North American food and beverage company with a 100+ year history. You may be familiar with their Oasis, Sun-Rype and private label juices, or their fruit snacks and barbeque, tomato and cranberry sauces. While the U.S. segment of their business has been challenged in recent years, the Canadian business has remained sound. Importantly, Lassonde has already been investing heavily to improve processes and shift production closer to U.S. based customers. Fortunately, Lassonde already has more U.S. facilities than Canadian, and Lassonde is currently laser-focused on improving the operating costs of its juice boxes and meeting robust demand, which makes sense in virtually any state of the world. Recently reporting Q1 results of high single digit year-over-year earnings growth, we believe Lassonde continues to prepare itself to be set up for the next decade, both in the U.S. and Canada. As a proud Canadian and father of school age children, I certainly am glad to be teamed up with an aligned, capable and clever management team.

Consistent preparation meets opportunity – Right Process & Luck

Mullen Group, one of the top-ten holdings in the QV Canadian Small Cap Strategy, recently announced a ~$190mm acquisition of Cole Group Inc., a North American leader in customs brokerage, freight forwarding and logistics. Deployments like this support our firm’s thesis that active management may play a larger role in the upcoming years then it has in the past. Mullen has been prepared with a sound balance sheet and prior reticence to invest at the peaks of the industry cycle, and it’s now ready to fund this acquisition of a solid business that supports their differentiated cashflow outlook. We look forward to visible earnings growth, while various public companies in recent Q1 reporting cut or suspended their earnings forecasts. Interestingly, the timing of better capabilities for dealing with cross border red tape, and incremental U.S. exposure, couldn’t have been planned any better as Mullen can now provide improved customs and logistics expertise to customers throughout this tariff conflict. While the right preparation likely will lead to sound outcomes most of the time, there are no guarantees. Over 15 years ago, although Mullen ‘struck out’ trying to acquire another customs broker, they stuck to their valuation discipline and continued to build an organization to be proud of. It may be telling that by Mullen ‘doing the right thing’ consistently, the previous owner of the Cole Group determined Mullen should be the future steward of the business.

When it comes to opportunistic windows of deploying capital, insights can be garnered from Sir John Templeton, who famously invested during 1939, amidst the start of the Second World War, as he felt markets were too pessimistic and bargains were to be had. Clearly, this is a very rapidly evolving conflict of a different nature, and investing indiscriminately in the cheapest companies on the market (as Templeton did) is not what we are seeking to replicate. However, we can say that through this trade conflict, due to the perceived higher risks in small caps as an asset class, select small cap companies today are most likely trading closer to ‘wartime’ prices, rather than ‘peacetime’. A wise man named Winston Churchill once said, “Never let a good crisis go to waste.” Our cash is at below average levels, as a number of Canadian small cap holdings are now trading below pandemic trough valuations, and well below long-term averages.

While it is unclear what the magnitude and duration of the current trade conflict will be, what is clear is that our preparation for unexpected market events or difficult market conditions and recent actions will continue to improve the incremental reward-to-risk profile of the strategy. We continue to drive forward to our objective of resilient returns over time, with preparation on both the strategy and company level, while sleeping easily at night.