I started at QV in February 2000, just over 25 years ago. Before that, I was with another Calgary-based money manager working on their commodity-focused mutual fund. The timing couldn’t have been worse as oil collapsed to near $10/barrel, gold traded down to less than $300/ounce, and other industrial metals collapsed. The firm lost 90% of its assets, and I was out of a job. To make matters worse, I had just gotten married and quickly became a fledgling house husband. It was my first experience with a “honey-do” list, and I discovered that my skill set wasn’t a good match for my new job description!

Within a few months, the sun shone on me again, and I joined QV. One year later, we had lost over 50% of our assets, as we were at the tail end of the internet bubble and Canadian small-cap portfolios were terribly underperforming. I must say – I started to wonder if my parents weren’t onto something when they enrolled me in accordion lessons at the tender age of 8 with the hopes of being the Croatian version of Lawrence Welk, rather than an investor! To this day, I proudly display my “Runner-up B Division” accordion trophy on my desk in the office as a reminder of what could have been! But back to my story. QV survived this tough period, barely, and slowly started finding our footing. Our investment process and focus improved, as did our performance. With time, our portfolio return compounded significantly. All the stocks no one wanted at the peak of the internet bubble suddenly became broadly attractive; the cycle had turned.

These two experiences were the most formative of my investment career. You learn the most through challenging periods. As difficult as it was to go through, I now look back with much appreciation. I certainly learned a lot about humility. The market can be brutal. If your experiences are only positive, you attribute everything to your own personal skill and prowess. That can come back to bite you if overconfidence seeps into your psyche. A good dose of humility is necessary to remain an objective and thoughtful investor. I also learned the importance of timing and luck. If the commodity fund I worked for could have just survived another couple of years, it would have benefited from one of the greatest multi-year commodity bull markets in history. Lastly and most importantly, I learned about the importance of staying committed to your investing. When QV was struggling, we had a choice. We could succumb to clients’ pressure to get “on board” with the high-momentum stocks of the day, in the hopes of not getting fired. Alternatively, we could take on career risk and remain committed to the portfolio we believed had significant embedded value, acting with integrity to do the right thing. By choosing the latter, we lost some clients but forged deep relationships with those who stayed, and we all benefited significantly afterward.

In some ways, the current market backdrop feels like déjà vu. Pick your QV fund for the past year or so, and it’s likely underperforming its benchmark. The absolute numbers remain excellent and significantly above long-term averages, but in the investment world, it’s small solace if you have clients that are more focused on why you’re not keeping up with the market. Thankfully, our clients understand what we do. Using our QV Canadian Small Cap Fund as an example, as of October 31, 2025, we’ve generated an annualized 2-year return of nearly 24%. Without knowing anything about the overall market, most people would be very pleased. But when you see the comparative return for the S&P/TSX Small Cap TR Index at 34%, people start asking what’s going on. Don’t get me wrong, that’s a completely reasonable question; they should try to understand why a manager is falling short and what’s driving returns. The issue arises when the investor focuses only on the numbers, without considering the risks a manager may have taken to achieve them, or whether a manager is sticking to the same discipline the client hired them for in the first place. The higher the returns, the less anyone wants to talk about risks, and the importance of risk management gets sidelined. Emotions get in the way of reasonable expectations.

At a recent QV Investment Committee meeting, our small-cap team, headed by Portfolio Manager Steven Kim, shared an important statistic with us. Looking back over the QV Canadian Small Cap Fund’s 25-year performance track record, we outperformed the benchmark 72% of the time1. This means that, at least a quarter of the time, we disappointed clients on an annual relative basis. Comparing a manager solely on short-term results without considering context can lead to short-sighted decision making. The type that can be financially punitive.

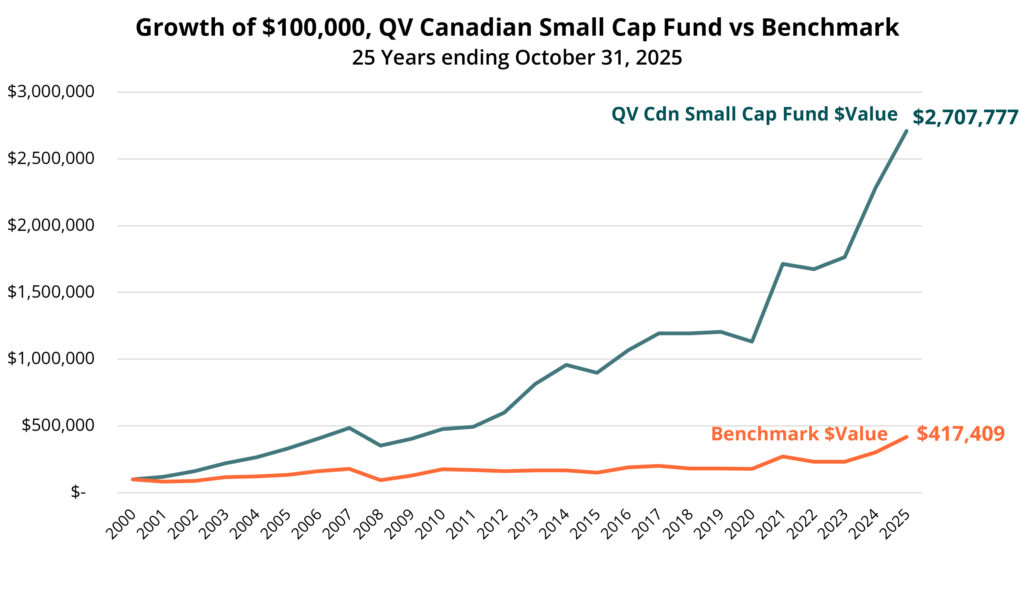

Take, for example, that over these 25 years, the QV Canadian Small Cap Fund has produced a 14.1% annualized return, including all the years we underperformed the benchmark. To put this in perspective, major global benchmarks, including Canada’s S&P/TSX Composite and both the S&P 500 and Russell 2000 in the US, have posted returns between 7% and 8% over the same period. Hypothetically, a $100,000 investment in the QV Canadian Small Cap Fund 25 years ago (beginning November 1, 2000) would have grown to $2,707,777, compared to $417,409 for the respective benchmark (5.9% annualized return), as shown in the chart below. Numerous clients, including QV employees, have invested in the Fund through this 25-year track record and benefitted significantly. Thank you, Steve and team, for sticking to your process regardless of the short-term relative results!

Source: QV Investors

It is long-term compounding rather than competing in the short-term performance derby that wins the investment game. We are thankful to so many of our clients who have taken this perspective in how they allocate their capital. I personally am very appreciative, as I’m not sure my parents’ backup master accordionist plan would have worked!

- All performance referenced in this commentary is as of October 31, 2025.

Canadian Small Cap Benchmark: November 2000–August 2001, benchmark performance is represented by the BMO Small Cap Blended (Unwtd) TR Index, which predates the inception of the S&P/TSX Small Cap TR Index. From September 2001 through October 2025, benchmark performance is presented by the S&P/TSX Small Cap TR Index.

Pooled funds are not guaranteed; their values change frequently and past performance may not be repeated. ↩︎