Reading the Autumn Leaves

The long, hot days of summer feel like a distant memory as the cooler months of autumn have abruptly arrived. Similarly, resilient North American economic data released during the first half of the year has recently been revised downward, weakening the prior narrative of strength and pointing now to a cooler economic trend.

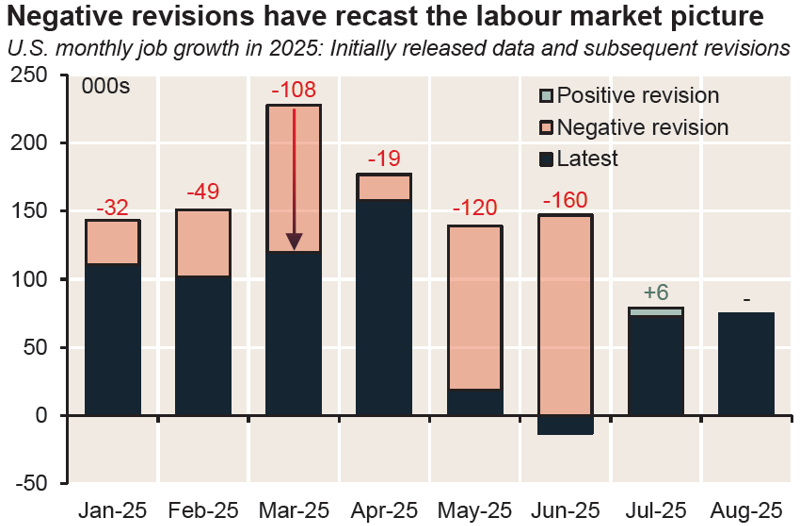

The most pronounced example is in the U.S. labour market, where a string of strong initial job gains earlier in the year experienced negative revisions that intensified in August, lowering the 3-month moving average of job gains to ~29,000, a markedly lower trend from the 3-month moving average of 232,000 initially reported back in January. The industry concentration of new hires has been equally concerning so far in 2025, as approximately 86% can be attributed to the Health Care and Social Assistance sector, while all other industries have recently been on a shrinking trend. This suggests the economy may be weaker than what was originally portrayed and provided the U.S. Federal Reserve (Fed) the justification to cut its policy rate in September. The ebbing payroll figures moved the unemployment rate a tick higher to 4.3% but this remains at a historically healthy level for now. Meaningful deterioration of the unemployment rate would require this worrisome trend to decline further as the crackdown in U.S. immigration has suppressed labour supply, lowering the breakeven rate of monthly job gains.

Source: NBC, Bloomberg

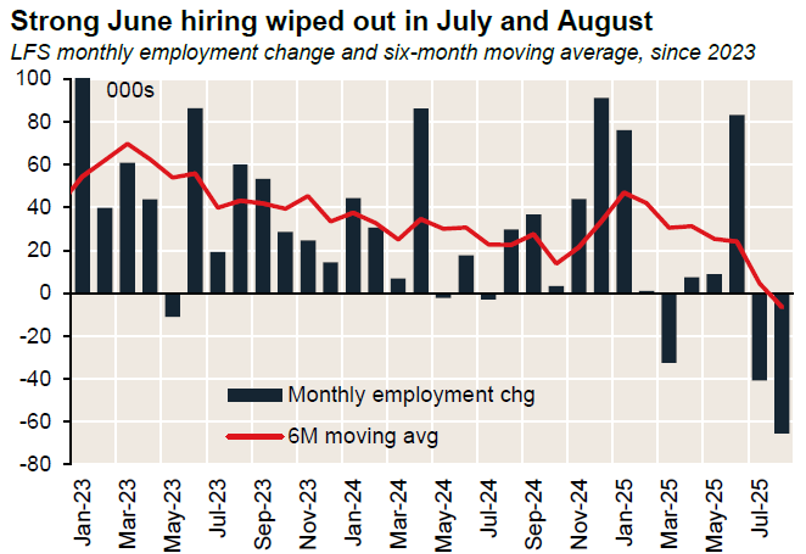

The economic weather has grown even colder north of the border. The Canadian labour market reported two consecutive months of broad-based net job losses in July and August, a condition that has historically been consistent with economic downturns. Since the beginning of the year, Canada has lost 39,000 jobs. This has pushed Canada’s unemployment rate steadily upward to 7.1%, a post-pandemic high and again another reversal of the early summer narrative of resilience. Expectations for a rebound in the third quarter have since been revised downward as a more challenged outlook has emerged.

Source: NBC, Bloomberg, StatCan

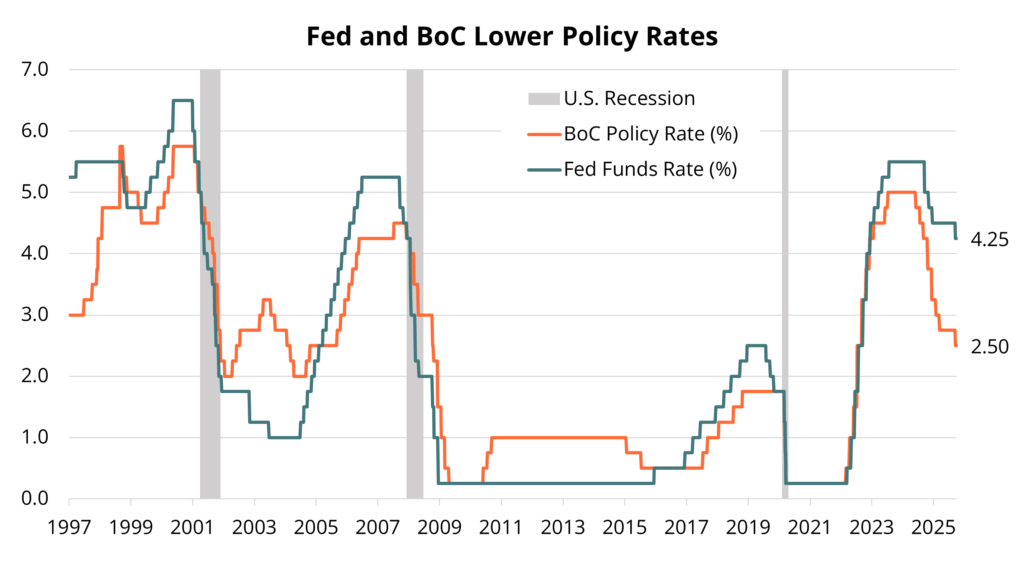

The swift reversal in the North American economic narrative is a powerful reminder that trends can change rapidly and destabilize expectations. Prior to these employment revisions, the market was not expecting a return to central bank interest rate cuts. However, weaker than expected employment reports provided the Fed and the Bank of Canada (BoC) sufficient evidence to lower policy rates by 25 basis points (bps) each. As both central banks’ interest rate policies are data dependent, the pace and extent of additional cuts will be reliant on how the future trends. However, future central bank policy decisions are likely to remain clouded by the unconventional policies being injected into the broader economy. In past cycles, investors who emphasized risk management at similar junctures were prudently positioned for the long term.

Source: QV Investors, Bloomberg

Not at Any Price

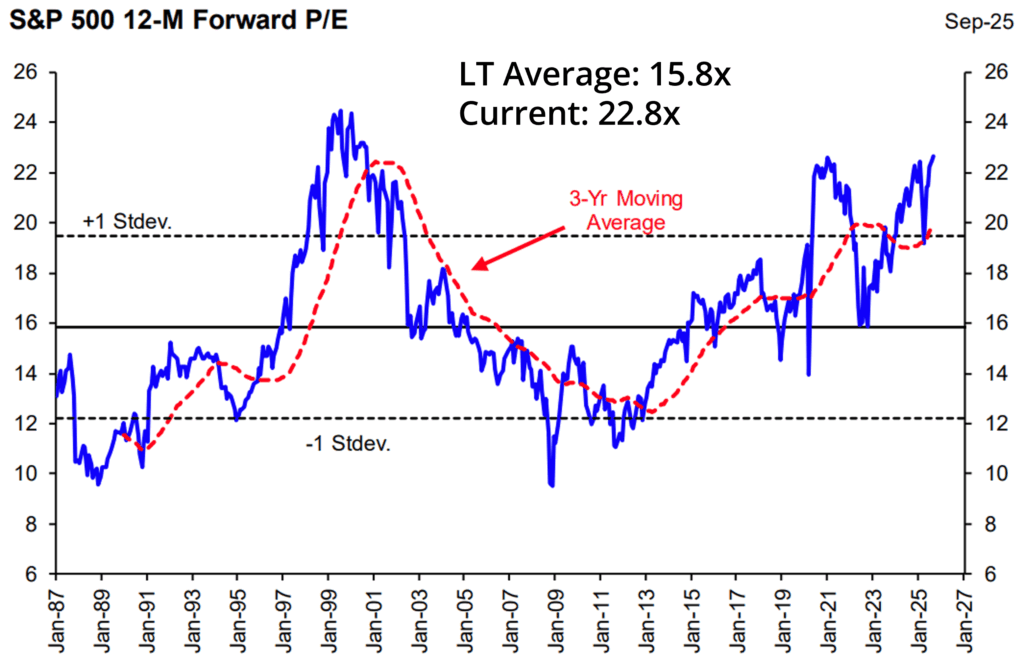

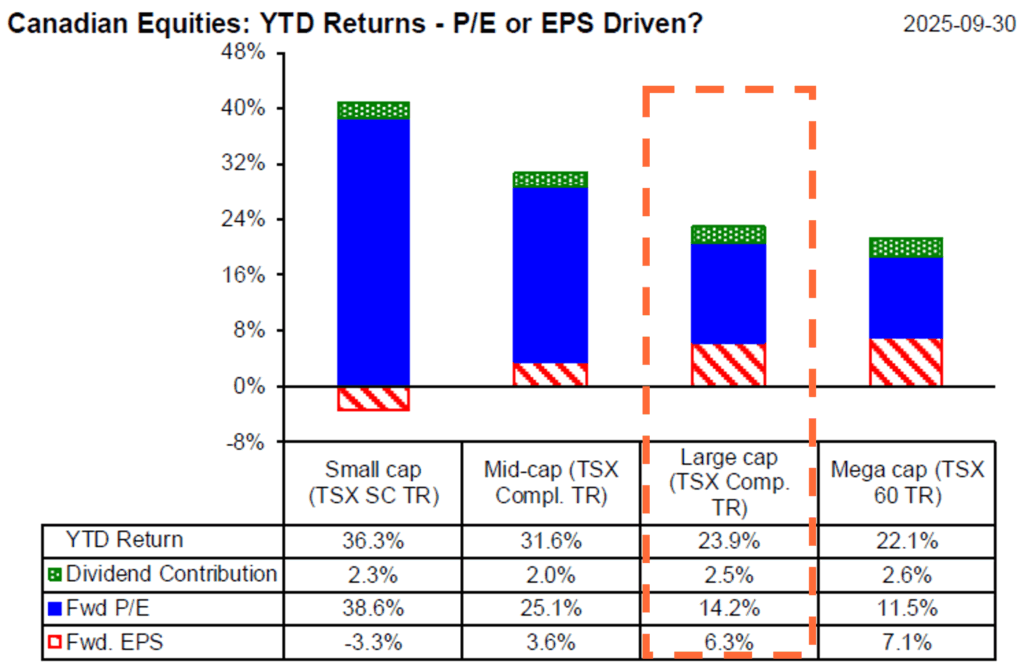

Equity markets rallied to new highs despite growing concerns of a softening macroeconomic backdrop. The S&P 500 Total Return Index gained 8.1% in USD terms and the S&P/TSX Composite Total Return Index rose 12.5% (CAD) in the third quarter. For context, these are typical returns generated over a full calendar year, let alone over a single quarter. Year-to-date returns continue to be robust, with the S&P 500 gaining 14.8% (USD) and the TSX Composite up 23.9% (CAD). A material contributor of these YTD returns has been from valuation expansion, especially in Canada. Of the three key components that drive equity total returns – earnings growth, dividend growth and valuation expansion – valuation is arguably the most unstable and market sentiment dependent. The S&P 500 12-month forward price-to-earnings multiple rose to 22.8x at the end of Q3. Still shy from the 1999-2000 peak of 25x, but easily in rarified air and a sign of market optimism today.

S&P 500 earnings growth has been uneven across corporate sectors. Sectors that are exposed to the AI-related spending boom are generating outsized earnings growth. But a handful of other sectors are not keeping up and some are struggling to produce any growth at all. Yet valuation multiples keep rising as investors are willing to pay near record prices despite the lack of broad-based earnings growth underpinning this market rally. Over-reliance on narrow market leadership and lofty multiples has historically not worked in investors’ favour.

Source: Scotiabank GBM Portfolio Strategy, LSEG, QV Investors

Canada’s TSX Composite has also seen valuation expansion, ending the third quarter at a 12-month forward P/E of 16.6x, a relative discount to the S&P 500. The TSX is quickly playing catch up and has outperformed the S&P 500 year-to-date. However, ~59% of the TSX’s YTD return has been attributed to P/E expansion, compared to ~37% for the S&P 500’s YTD return. A healthy mix of corporate earnings growth in Canada would support the durability of these market gains.

Source: Scotiabank GBM Portfolio Strategy, Bloomberg

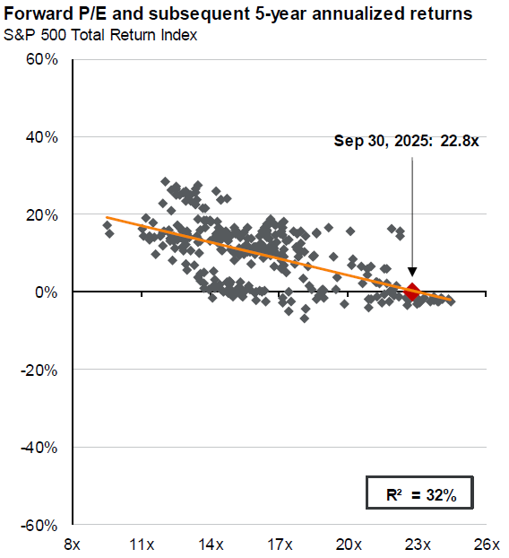

The market’s expanding valuation is not a surprising development. A closely held tenet asserts that quality businesses deserve a premium over time. Rather, it is today’s starting valuation that historically suggests unattractive future returns. The chart below shows that at 22.8x for the S&P 500, the subsequent 5-year annualized returns have historically been towards the bottom right of the scatter plot, indicative of sub-par returns going forward. Preparing for challenging periods and maintaining portfolio resilience may not be the flavour du jour, but risk management ensures portfolio health and a diversified game plan that can succeed in many market environments.

Source: J.P. Morgan Guide to the Markets, September 30, 2025

Keeping it Lean

It is often understood that valuation discipline is the key to achieving a safety margin. While price discipline is an important factor, an emphasis on multi-faceted quality attributes also helps maintain a strong safety margin. One such quality is a lean balance sheet where debt levels are sensible. A sustainable level balances debt with a business’s earnings ability and cyclicality, without hindering management’s ability to grow. The future can be unforgiving at times, but financial flexibility in those periods can be both a competitive advantage and an enviable position of strength. While this seems obvious, not all businesses are managed this way.

Management teams willing to maintain a strong credit profile are able to take advantage of opportunities in periods of market weakness and strengthen their competitive positioning for the long term. One such example of this is Tourmaline Oil Corp, a holding in the QV Canadian Equity Strategy. Tourmaline is a natural gas producer that has been a steady acquirer over the last few years post-pandemic and has grown into the largest natural gas producer in Canada. Tourmaline operates with one of the lowest cost structures in the energy producer industry, which helps it generate strong free cash flow in different market environments to quickly deleverage following acquisitions, as well as return capital to shareholders via special dividends. Leverage is kept low as management recognizes the inherent cyclicality of the energy industry. Maintaining their balance sheet accordingly provides an advantage over higher-cost peers, especially during times of depressed natural gas prices.

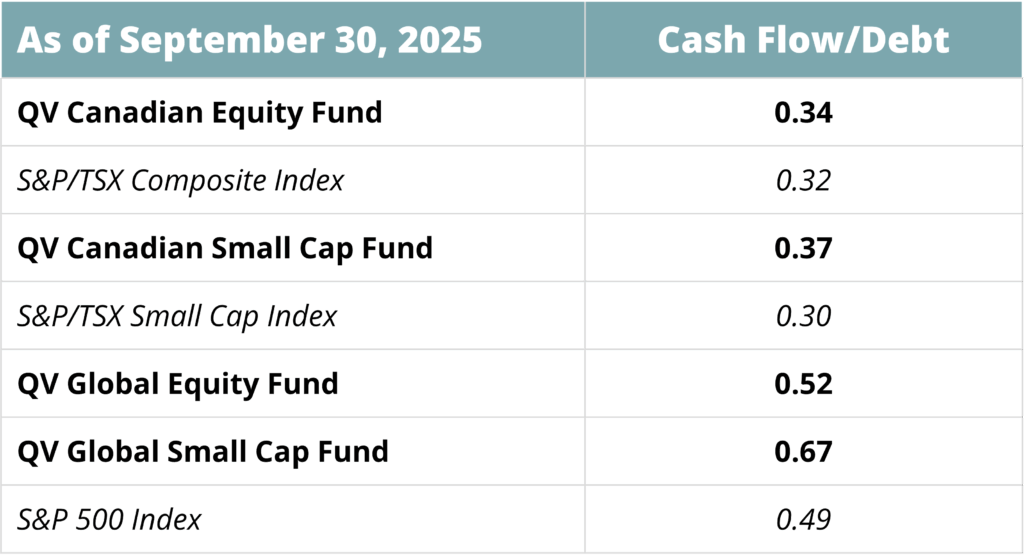

Like energy markets, stock and credit markets also fluctuate in cycles. Emphasizing businesses with balance sheet strength improves portfolio resiliency when the unexpected occurs. As well, investing in cycle-minded management teams that strengthen their competitive position during tough times improves their business permanence and long-term outlook. Our equity strategies hold a balance sheet advantage on a trailing cash flow to debt basis. This advantage is also maintained over time to better ensure staying power and durable growth.

Source: Capital IQ & QV Investors Inc.

As policy rates decline and the cost of capital cheapens, businesses and households may incrementally take on more leverage, as is typically the case. This may fuel a continued market melt-up leading to further valuation expansion to even richer levels. QV’s focus remains centered on a multi-element discipline to achieving a margin of safety. QV’s investment strategies are not the market. They are built differently and so are expected to behave differently. Political and economic uncertainty remains elevated at a time when market multiples are priced with little margin for error. Starting valuations matter and so does financial flexibility. A focus on managing risk over maximizing returns during times like today has typically paid off in the past as the market does not always move in a straight line.