Written by the Canadian Large Cap Team: Diana Chaw and Daniel Morgan

“I will live in the Past, the Present, and the Future.” – A Christmas Carol

In A Christmas Carol, Ebenezer Scrooge is visited by the Ghost of Christmas Yet to Come. Horrified by what the future looks like, should he continue with his miserly ways, Scrooge was given the chance to change his behaviour and avoid the future he does not want. We envy Scrooge today — many investors (ourselves included) would very much like be visited by The Ghost of Public Markets Yet to Come for a glimpse into the future.

The future is always unknowable, but today it seems particularly so. The threat of tariffs continues to loom large and, at least as of the time of writing, Canada has yet to ink any trade deal with the US. Major conflicts around the globe rage on. OPEC appears to want to win market share again, which often does not end well for the price of oil. With the great deal of uncertainty in front of us, how then are we approaching investing in the Canadian equity market? We give some thoughts on how we see the large cap equity landscape today.

A Tale of Two Equity Markets

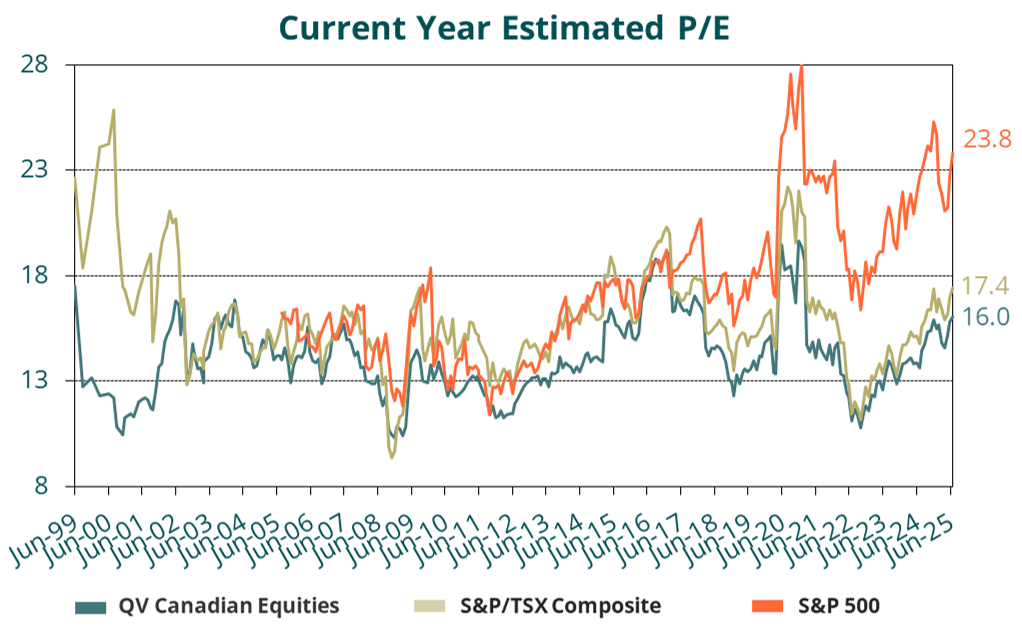

We are of the opinion that valuation downside risk is lower in the Canadian markets compared to the US equity markets. Despite sharing the same landmass, the Canadian and US equity markets have significantly deviated over the last decade. The 10-year annualized return of the S&P/TSX Composite has averaged 9.6% compared to the S&P 500 at 13.6% in constant currency terms. The ~400 bps of outperformance over ten years is considerable — an investor who invested $100 in the S&P 500 would have more than tripled her money in the last ten years compared to the Canadian investor who would have only doubled his in the same time frame. The strength in the US is driven in part by higher earnings growth, but increasingly due to higher valuations. Valuations for the S&P 500 are now above all time highs, and our colleagues have written about how we see risk to those valuations.

In our view, the Canadian equity markets do not have the same valuation risks, as shown in the chart below. While Canada has also seen strong equity markets in recent times, valuation levels are well below the US. At this point, valuation has simply bounced from all time lows in 2022 to a normal valuation level range relative to history. QV’s Canadian Equity Strategy remains at a discount to the TSX and within its normal range.

Source: Capital IQ & QV Investors. S&P 500 data only available since 2005.

When we think about overall equity market risk, downside risk comes in the form of 1) lower than expected earnings and 2) valuations compressing. We are not naïve to believe that the Canadian markets will have less earnings risk than the US in an economic downturn, but we believe that we do not possess the same degree of valuation risk.

Great Expectations (Over Time, That Is)

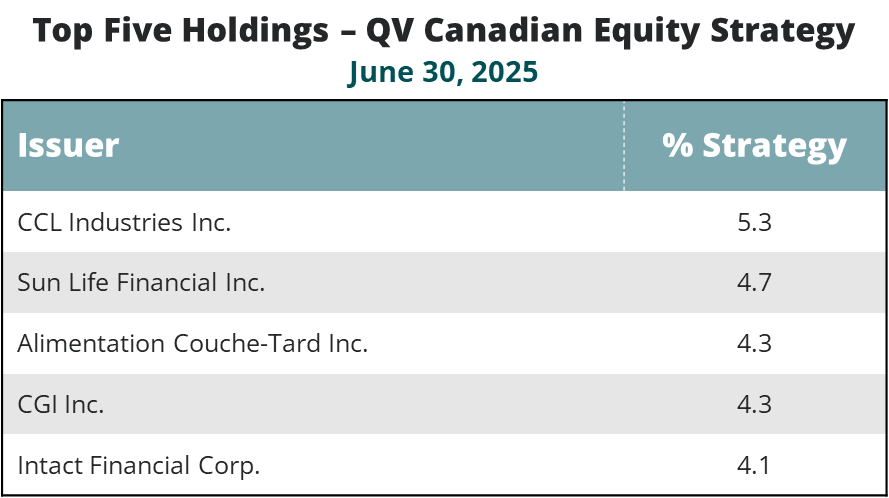

Source: QV Investors

With valuation risk relatively contained in the strategy (in our view), how then do we become comfortable with earnings risk in a time of uncertainty? To begin with, what we emphasize to all our clients is that we are not forecasters. Investment decisions are not driven by an overriding economic (or geopolitical) view. In practical terms, what this means is that we tend to lean towards companies that meet our expectations for growth over an economic cycle.

In good times, many of our top weights will enjoy good, but perhaps not explosive growth (and often do not experience valuation expansion associated with such explosive growth). On the other side however, our largest weights are also not the companies prone to significant earnings downside in tougher times. Lower earnings risk, coupled with more reasonable starting valuations should, in our view, shield the downside more than the overall market. To be clear, over an economic cycle, the largest weights in our strategy should still deliver market competitive growth rates.

CCL Industries, the largest single investment in the QV Canadian Equity Strategy, which we have written about in past Insights, is comprised of recession-resilient businesses that grow at a rate comparable to GDP plus one or two percent per year. The company has supplemented growth with acquisitions, typically when the economy is not doing well and sellers are more willing to make a deal. Over the last 20 years, this strategy has resulted in CCL growing its EPS more than five-fold, during which time it posted just three years of revenue declining, albeit by a shallow amount. We have few reasons to expect it to deviate from its long-term trend of growing and perceive its valuation to be more than reasonable at its current share price.

Another example includes Alimentation Couche-Tard (ATD), which has seen sales growth in its core US market slow down because lower-income consumers have pared back spending on snacks, meals away from home and travel. Less tourism in its largest markets, including Florida, Arizona and Texas, have dented sales growth too. Though these are apparent problems for the growth of the business, EPS has only fallen about 10% from its prior peak, which we think demonstrates the resilience of the business.

Hard Times Can Be an Opportunity

Although QV prefers companies with less volatile but still strong earnings growth, this does not mean we are always averse to considering investments in parts of the market that are experiencing notable downturns. While broad based economic recessions are a regular but infrequent occurrence, industry specific downturns happen more regularly, even when the overall economy appears otherwise stable. One example is the transportation industry today.

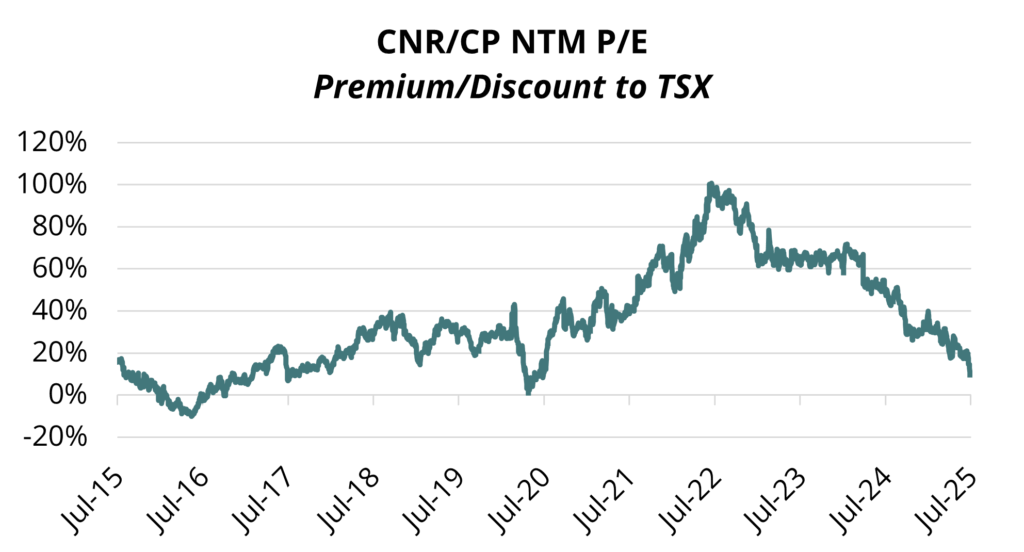

Source: Capital IQ & QV Investors

There has been a transportation recession over the last two years, caused by weak North American industrial production and overcapacity in the trucking industry. Additional risks have arisen from tariff threats, which risks pushing out volume recovery even further. QV is a long-term shareholder of Canadian National Railway (CNR) and Canadian Pacific Kansas City (CP) — both in our view being among the highest-quality companies in the strategy. As the chart above shows, on price to earnings, CP and CNR commanded, at its peak, a near 100% premium to the TSX. Today, the premium has almost entirely vanished. We view this as an opportunity to add to our position. On the more cyclical side, QV also owns TFI International, a trucking powerhouse whose shares pulled back this year amid a weakened outlook. QV had gradually reduced exposure to TFI through 2024 due to valuation concerns. Given that this was a small position early in the year, we have strategically added to this investment as the risk-reward dynamics appear stronger.

To end, when Scrooge came face to face with the Ghost of Christmas Yet to Come, he said, “I fear you more than any spectre I have seen. But as I know your purpose is to do me good… I am prepared to bear you company”. The future of the markets seems uncertain, perhaps even a bit scary today, but we believe we are prepared to face it with our consistent approach.