Written by the Global Large Cap Team: Mathew Hermary, Jared Holaday, Brendan Harrington

Although US equities trade near a record high price to earnings (P/E) multiple, the dispersion of global valuations among market sectors and geographies remains unusually wide. For investors focused on generating reasonable returns while minimizing the risk of loss, we believe such valuation divergences continue to support reasonable opportunities despite an elevated probability of lackluster mid-term prospects for the US stock market. Below we share an update on the positioning of the QV Global Equity Strategy and where we have been finding value.

Position and Opportunity

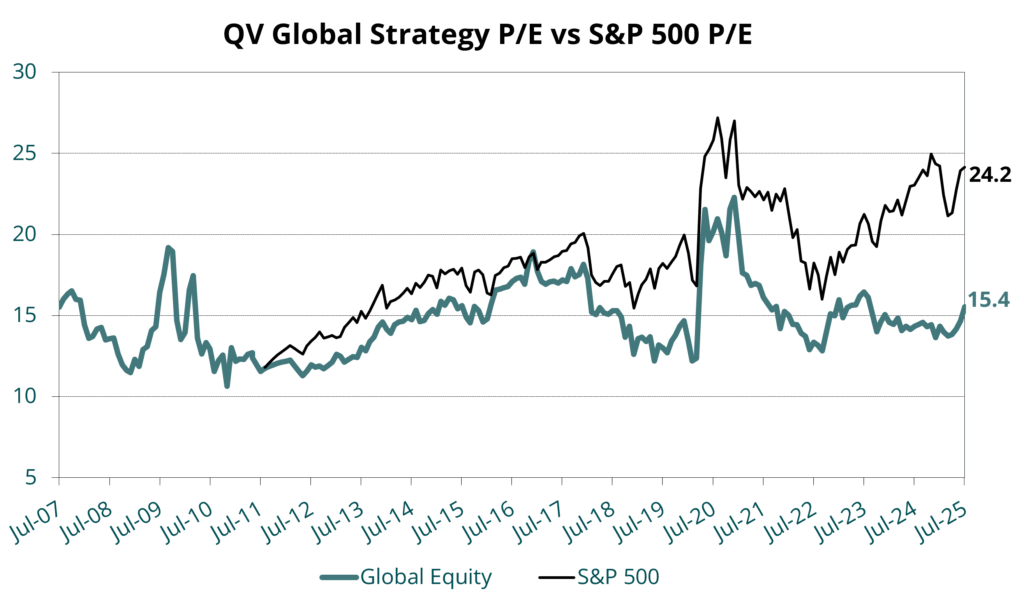

Against a backdrop of steadily expanding P/E multiples, QV’s global strategy has remained focused on owning businesses which we expect will deliver a reasonable mix of earnings growth and dividends, while still providing a margin of safety from a valuation perspective. The strategy’s valuation currently trades at just 15.5x, the cheapest on record relative to the S&P 500. The median estimate for earnings growth among our businesses is 11% next year, with an aggregate return on equity of 19.8% and a dividend yield of 2.5%. Taken together, we believe these factors provide a framework for acceptable return potential with much less risk than the broader stock market.

Source: Capital IQ & QV Investors

Diversified Globally

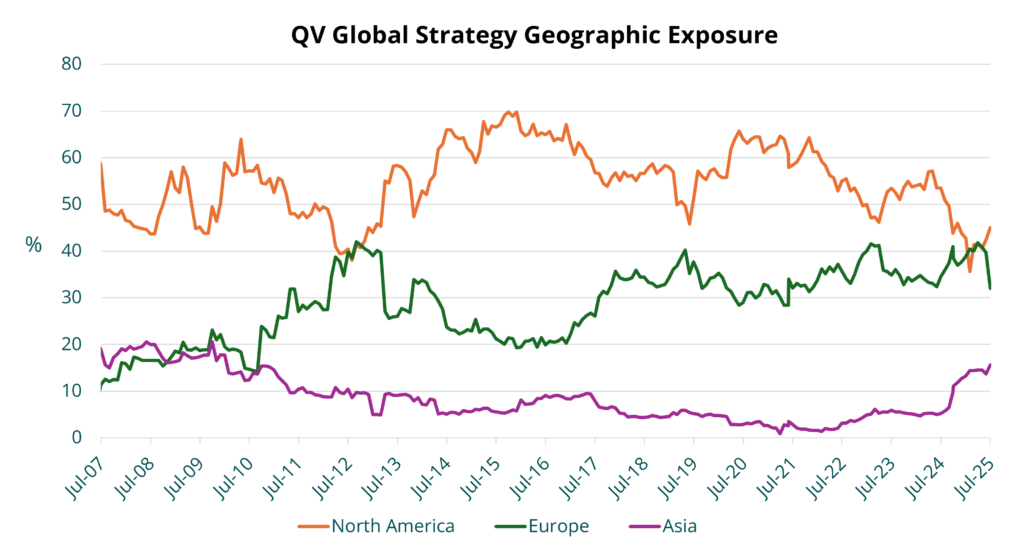

Over the last 12 months, our global equity team has incrementally found more value in regions beyond the US. At the end of July 2025, the strategy’s exposure to US stocks was ~45%, near the lowest since 2012 as rising valuations have broadly compressed the US opportunity set relative to those available internationally. At ~32%, the strategy’s exposure to Europe is near its average level since 2018. Exposure to Asia however, has risen to ~15%, the highest since 2010.

Source: Capital IQ & QV Investors

Within Asia, we purchased Tokyo Electron in January. Tokyo Electron is a leading Japanese manufacturer of semiconductor fabrication equipment discussed in more detail later in this letter. In the second half of 2024, we also added four high quality businesses in China as concerns over the country’s economic outlook pressured the domestic stock market, resulting in unusually attractive valuations. Our largest purchase was Tencent, a founder-led internet conglomerate that has over 50% market share in online Chinese gaming and which also operates WeChat, a super app with ~1.2 billion monthly average users that provides it with leading positions in multiple verticals including social media and fintech. Given its exposure to expanding end markets in gaming, digital ads and cloud services, we expect the company to generate strong free cash flow growth for many years. We also recently increased long-term QV holding Samsung Electronics earlier this year.

Samsung: Value in an Expensive Market

Many people associate Samsung’s business with smartphones and TVs. However, the bulk of profit is generated from its semiconductor business where it is the market leader in the highly consolidated DRAM and NAND memory chip industry. While the memory industry can be volatile in the short-term due to fluctuation in customer inventory needs, the larger forces of digitalization and the rampant expansion of cloud services and artificial intelligence are driving secular growth in memory demand. Over the next decade, we expect a high single digit industry growth rate to propel Samsung’s revenue higher.

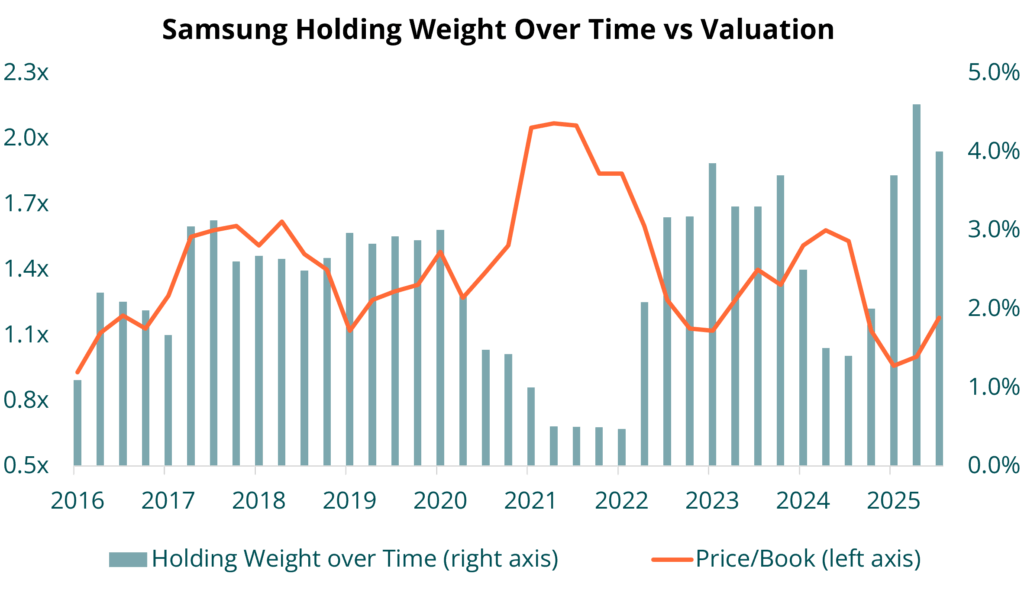

Throughout a typical memory chip cycle, Samsung’s valuation also tends to oscillate significantly as shown by the price/book ratio line below. In the past, QV’s global strategy has taken advantage of this cyclicality, owning the business at a higher weight as the valuation appeared cheap due to temporary weakness in the memory cycle, and at a lower weight as memory demand and Samsung’s price/book appeared to approach cyclical peaks.

Source: Capital IQ & QV Investors

Alongside cyclical weakness, Samsung’s valuation declined toward historically low levels in the last year as peers Micron and SK Hynix gained market share from Samsung in High Bandwidth Memory chips, a category of semiconductors required for memory intensive AI workloads. We increased the weight during this time as we thought that Samsung’s scale should allow it to reclaim market share and even if this proved difficult, the risk of loss appeared low given a trough valuation and support from improving cyclical dynamics in DRAM and NAND. From our perspective, Samsung appears to be the type of asymmetric trade-off that we seek – attractive upside if we are right and limited downside if we are wrong.

Shifting Sector Composition

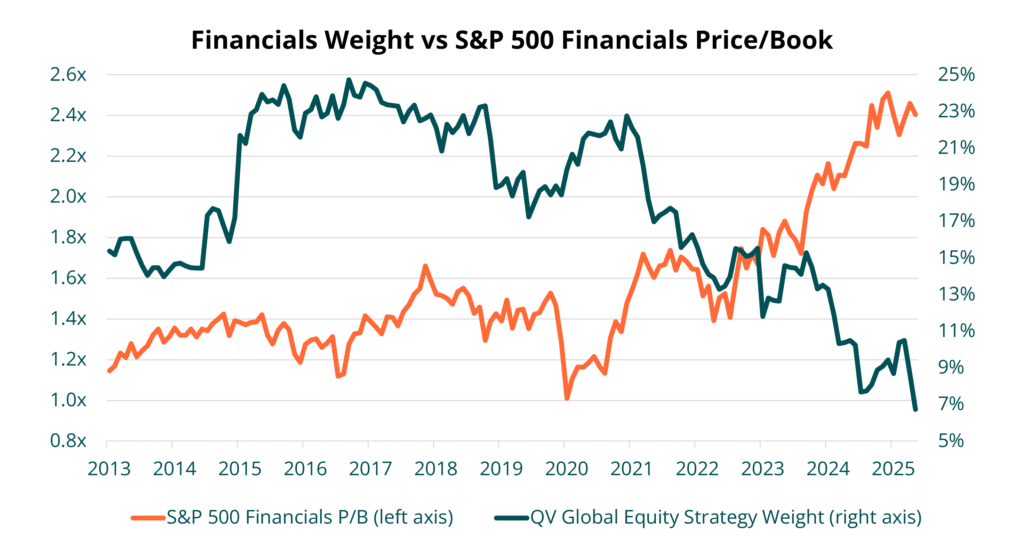

While we invest in businesses on a fundamental bottom-up basis, occasionally opportunities appear broadly across an entire industry or sector. Between 2015-2021, the global strategy was heavily invested in Financials businesses, given low valuations and strong earnings growth profiles across many high-quality banks and insurers.

However, aggregate sector valuations are currently near 15-year highs, and it has been much more difficult to uncover Financials businesses where return expectations over the next 3-5 years provide adequate compensation for valuation and economic risks. As a result, the strategy’s Financials sector exposure is currently at its lowest level in 12 years.

Source: Capital IQ & QV Investors

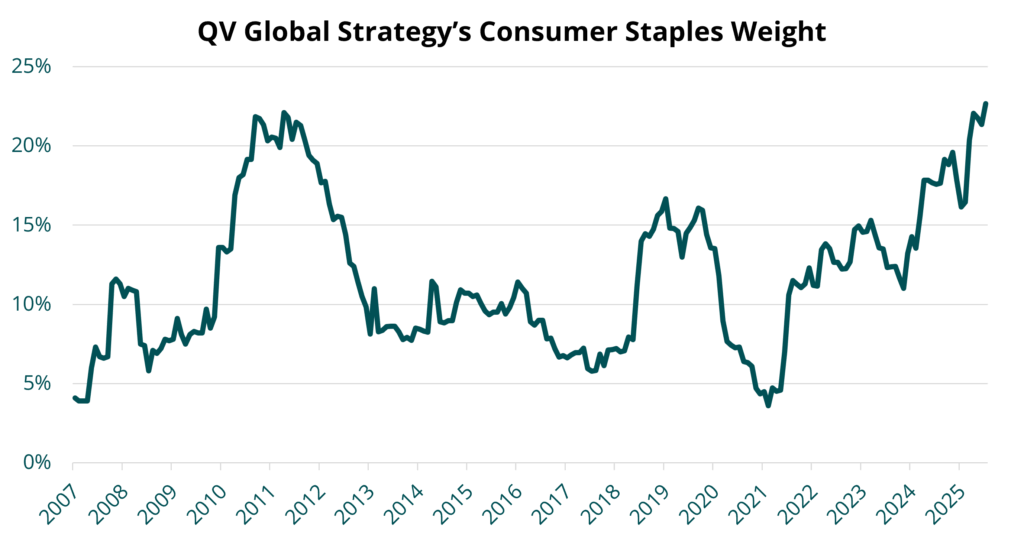

Meanwhile, the strategy’s Consumer Staples weight has risen to the highest level on record in the last 12 months as our team has continued to identify superior risk/reward dynamics in a number of Staples businesses than are broadly available across the stock market.

Source: QV Investors

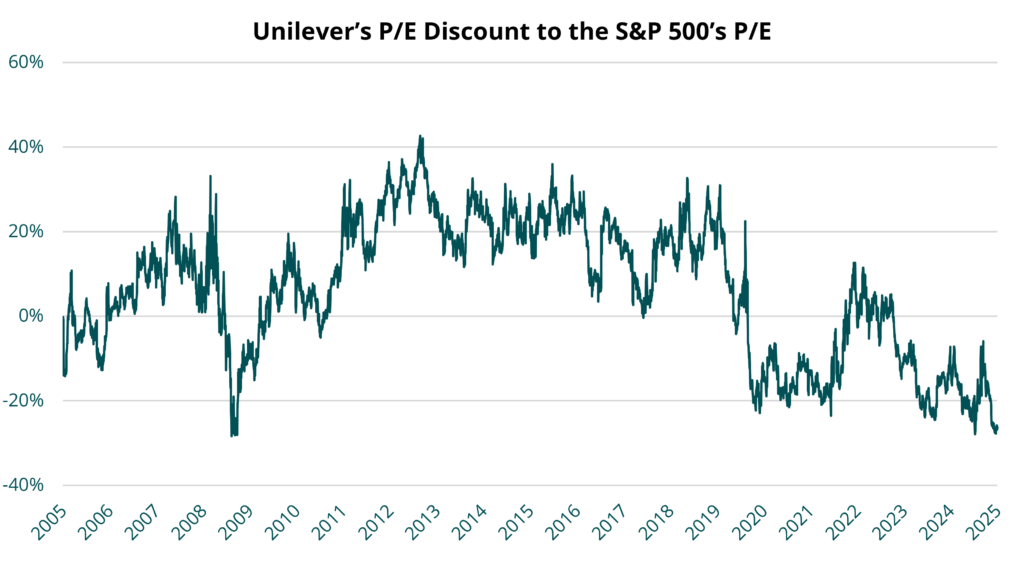

Over the prior two years, capital has consistently flowed into expensive ‘momentum’ stocks experiencing high current growth and stock price gains alongside a broader shift to investor risk-taking and speculation. This has left high dividend yielding, non-cyclical businesses with more mundane growth prospects far removed from the immediate limelight. With such a lack of apparent investor interest, many valuations among Consumer Staples businesses have declined toward near all-time lows relative to the S&P 500.

QV holding Unilever currently trades at just ~17.5x earnings. It offers a 3.2% dividend yield, and we believe it can grow earnings at ~7% over the next few years. Along with dividends, this could potentially equate to low double digit returns which could be further augmented by an upwards valuation reversion to its historical 19-20x range despite relatively low downside risk given the stability of profits and the undemanding P/E. In the current market environment, this is another example of the kind of trade-off – reasonable upside with little downside, that appears attractive to us. Of course, if there were a steeper decline in the stock market at some point in the next few years which offered opportunities to buy businesses with superior compounding characteristics at considerably more attractive valuations than are broadly available today, defensive holdings like Unilever could also provide a stable source of funding.

Source: Capital IQ

New Opportunities

In the first seven months of the year, we also added five new businesses which we believe enhance the long-term compounding characteristics of the global strategy.

Ashtead is a UK-based rental equipment provider that derives more than 90% of its operating income in the US. After following this business for five years, we were able to initiate a position at an attractive multiple of its invested capital as the share price came under pressure in response to near-term softness in construction markets. Ashtead has many characteristics which we admire. It is a scaled consolidator that has doubled its share of a fragmented market over the last decade; it is benefiting from a secular shift toward customers renting over owning equipment; and management has consistently shown a thoughtful approach to capital allocation through disciplined acquisitions and greenfield expansion. Alongside share buybacks, we believe Ashtead can grow earnings at a low teens rate in future years.

Dollar General is the largest discount retailer in the United Sates with more than 20,000 small-format stores in rural communities. We initiated a position at a ~23% discount to its long-term average P/E multiple as the company began to demonstrate progress on operational initiatives to reverse inflation-driven margin pressure and inventory shrink that had pressured earnings and the share price over the prior two years. Alongside an upwards normalization in operating margins, we expect 10,000 to 11,000 potential new store opportunities and a focus on higher-return remodels of the existing store base to extend the duration of Dollar General’s growth and its return on invested capital in future years.

With prominent brands like Clinique, MAC Cosmetics and La Mer, Estée Lauder is a global leader in prestige beauty that we purchased near a decade-low valuation on our estimates of normalized earnings following operational missteps including overexposure to the duty-free travel market in Asia. With clear progress towards better execution, renewed market share gains and a path to profit margin recovery, Estée’s shares appear attractive relative to its earnings growth potential.

Applied Materials and Tokyo Electron Limited are the world’s first and third largest global manufacturers of semiconductor fabrication equipment (SFE) with each commanding dominant market share in several key product segments. These companies build the equipment that turns silicon wafers into semiconductors – the brains of modern electronics and digital infrastructure. The mission-critical role semiconductors play in all aspects of our daily lives is set to continue accelerating in the decades ahead, and we expect the market to grow at a high-single-digit rate to 2030. In addition, rising manufacturing complexity is driving increased SFE density and incremental market share gains for leaders such as AMAT and TEL. Both companies share endearing qualities of being wide-moat, high ROIC, and net-cash providers of mission-critical pick-and-shovels to an industry with a very robust secular growth trajectory. We expect this combination will provide a persistent medium-to-longer-term earnings growth tailwind for both AMAT and TEL.